Choosing the right 2Checkout alternative

Find the best 2Checkout alternative for your business and customers. Why businesses look for an alternative and the best solutions on the market.

What is 2Checkout?

2Checkout is a merchant of record and an online payment service designed to make international sales easier for businesses. Founded in 1999, the company has since been acquired by Avangate in 2017 and by Verifone (a retail payments device company) in 2020.

2Checkout provides various payments solutions, with three main products:

1) Payment processor

Sellers often come to 2Checkout for its payment processing solution, which is something it provides to many types of businesses - including providers of both physical and digital goods.

2Sell is its basic product in this category, which allows card payments (including PayPal) and uses integrated carts to handle the checkout.

There’s also 2Subscribe, which is essentially the same model as 2Sell except it has recurring billing logic for subscriptions.

2) Merchant of record

2Checkout’s other main product is a merchant of record (MoR) offering. Called 2Monetize, it includes the handling of tax, payments and subscriptions. It’s only available to businesses selling digital goods, like SaaS companies.

3) Add-ons

2Checkout also has a series of add-ons available across the above products. These include:

- 2Convert (for 2Sell & 2Subscribe): Checkout recovery and localization

- 2Bill (for 2Sell) : A subscription package

- 2Recover (for all categories) : Auto card updated, improved retry logic

- 2Service (for all categories) : Charged professional services/consultancy

- 2Partner (for 2Monetize) : Affiliate network and tooling

As an all-in-one payment solution, you can see the appeal for businesses that want to grow fast. It offers separate products for separate needs, as well as integrations to plug with additional functionalities.

Who is 2Checkout good for?

There are, generally speaking, two kinds of businesses that 2Checkout works best for:

- Ecommerce : 2Checkout is a legacy merchant of record for any digital ecommerce, covering payments, subscriptions, and compliance. It is specifically positioned as a ‘monetisation platform’.

- Physical goods : As a payment processor, 2Checkout supports payments for those selling physical products, including taking orders and shipping addresses.

2Checkout is generally more suited to businesses with few products, as the setup can be complex.

Is 2Checkout the best option for selling SaaS?

While 2Checkout doesn’t specialize in SaaS, there are a number of reasons SaaS founders choose it. These include:

- Support for a broad range of business types: It serves various businesses via MoR and payment processing products, including e-commerce, digital products and downloads, physical products, and SaaS.

- Integrations available for additional functionalities: these include checkout recovery, localization, subscription packages, autocard updater, improved retry logic, charged professional services and consultancy, affiliate network and tooling

But there are certain capabilities that 2Checkout doesn't support which can complicate things for SaaS businesses.

As software companies grow, their go-to-market strategies mature. Many move into subscriptions as a route to scaling revenue. These developments introduce greater complexity for the engineering of a SaaS company’s revenue delivery infrastructure; complexities that 2Checkout doesn’t provide adequate solutions for.

When it comes down to it, you need to make sure you’re covering all areas of your revenue delivery, including:

- Subscriptions and recurring billing

- Localization

- Customer support and growth advisory

- Data, reporting and analytics

2Checkout does not provide a complete solution for strong SaaS growth strategies, which is why we encounter so many SaaS leaders looking for an alternative solution to better and more efficiently serve their customers.

Five reasons why SaaS businesses look for an alternative to 2Checkout

At Paddle, we speak to dozens of SaaS founders and executives each month who are looking for alternatives to 2Checkout.

From these conversations, we’ve developed an in-depth understanding of why SaaS businesses decide to move away from 2Checkout. Here are the top five reasons:

1) Inflexible subscription models hold back SaaS growth

2Checkout’s subscriptions aren’t flexible when it comes to managing plans, particularly if you’re looking to support plan upgrades or add-ons. The processes for upgrading subscriptions can be restricted based purely on customers’ chosen payment method at the checkout, for example. This can mean building a combination of plans to process a singular upgrade properly. But that’s not all.

The lack of flexibility in general can leave customers frustrated. The difficulty for customers to make simple changes to their subscriptions has the knock-on effect of increasing support tickets and queries - more on that below.

If you decide at some point that you want to move away from 2Checkout, migrating your subscriptions is not made easy. 2Checkout typically refuses to help migrate your live subscriptions to any other platform. Without the data migrated across, your customers would then have to re-subscribe when you moved to the new provider. This risks high levels of churn and revenue loss.

2) Higher payments failure, lower payments performance

2Checkout is associated with lower payment performance than other similar payment providers for a number of reasons.

One reason is because it accepts and processes payments for all kinds of businesses. This means software businesses can be mixed in the same feed as high-risk, high-chargeback industries (eg. adult content) which can have an impact on your overall payment performance and revenue.

In April 2021, 2Checkout was forced to stop processing payments via Mastercard for sellers in some regions. For context, we see 37% of our global credit card payments at Paddle are run over Mastercard. For sellers affected, that’s a lot of revenue to miss out on.

Other recent changes have made an impact on payment performance. Since being acquired by Verifone in 2020, we hear from former customers of 2Checkout that a much higher proportion of payments have been failing.

Finally, while you can deeply customize your checkout with the 2Sell or 2Subscribe add-ons, this isn’t possible if you’re using 2Monetize, their MoR platform. This means you need to choose between building a brandable, top-converting checkout experience or having your sales tax compliance taken care of – a tricky choice.

3) Slow customer support

One of the most common complaints we hear from SaaS founders and executives about 2Checkout is their slow response to support tickets.

With 2Checkout’s restrictive and inflexible platform being frustrating enough as it is, slow customer support only highlights and exaggerates this for fast-paced companies, like those within the SaaS industry.

Subscription changes are made difficult enough with 2Checkout, but slow response time from the support team on top of that? That’s time - and potentially revenue - wasted.

2Checkout also handles customers’ orders and subscriptions for the 2Monetize ‘merchant of record’ product too, which means a slow responsiveness isn’t just a frustration for your team, but for your customers too.

The net result of a high volume of tickets and a slow response rate? Poor customer experience and high churn - not to mention bad reviews. And that’s going to impact your bottom line.

4) SaaS companies outgrow 2Checkout’s capabilities (particularly in B2B)

2Checkout has a legacy base of one-time software companies who predate the SaaS era, which means that while it does serve software companies, it lacks the support and functionality required by subscription-based SaaS businesses.

Their lack of focus on SaaS businesses means their current feature set and product roadmap doesn't match up to the evolving needs of modern software companies.

SaaS businesses want to move fast, but there are a number of drawbacks with 2Checkout that make growing a customer base difficult - and that’s not going to help revenue numbers either. Some of these drawbacks include:

- Inflexible subscriptions (as discussed above)

- Unsuited checkout experiences

- Lack of invoicing

On top of subscription billing and invoicing limitations, 2Checkout doesn't provide any dedicated support or SaaS expertise on how best to use the platform for strategic growth. It simply provides a toolkit, leaving sellers to execute their own strategies.

With a range of SaaS-focused platforms out there, you can see how 2Checkout’s lack of focus, support and functionality for software businesses leads to executives looking elsewhere. Simply put: It is not a future-proof solution.

5) Higher cost than alternative solutions

With an array of products, comes an array of pricing.

2Sell and 2Subscribe are payment processing and subscription tools, while 2Monetize is a MoR platform. Each of the products need integrating with additional tools to make them fully worthwhile - you can check out the full list of add-ons above.

But that’s where the costs become higher without you realizing. With the additional revenue tools, MoR extras, plus the resources spent on handling global sales tax, invoicing and SaaS metrics, the total cost quickly adds up beyond their headline rate.

Choosing the right alternative to 2Checkout

So, now we know why SaaS businesses look around for alternatives to 2Checkout, how are other solutions addressing these problems, and how do you know which is right for you?

You’ve got two options, either going for the all-in-one solution of a revenue delivery platform, or a more specific solution of a merchant of record.

Option #1: A Revenue Delivery Platform

“What is a revenue delivery platform?”, we hear you say. Well, it’s a more unified solution for your business in terms of, well, delivering revenue.

A revenue delivery platform takes on all the headaches of the payment and billing process, supplying you with all the resources, technology and general support that you’ll need along the way.

Let’s compare a revenue delivery platform to 2Checkout for context:

- More flexible subscription models: Catering to any and all SaaS needs and optimizing your NRR

- Dedicated revenue delivery advisors: Additional SaaS growth expertise to help you scale

- Optimized checkout experience: Maximizing conversions and saying goodbye to payment failures

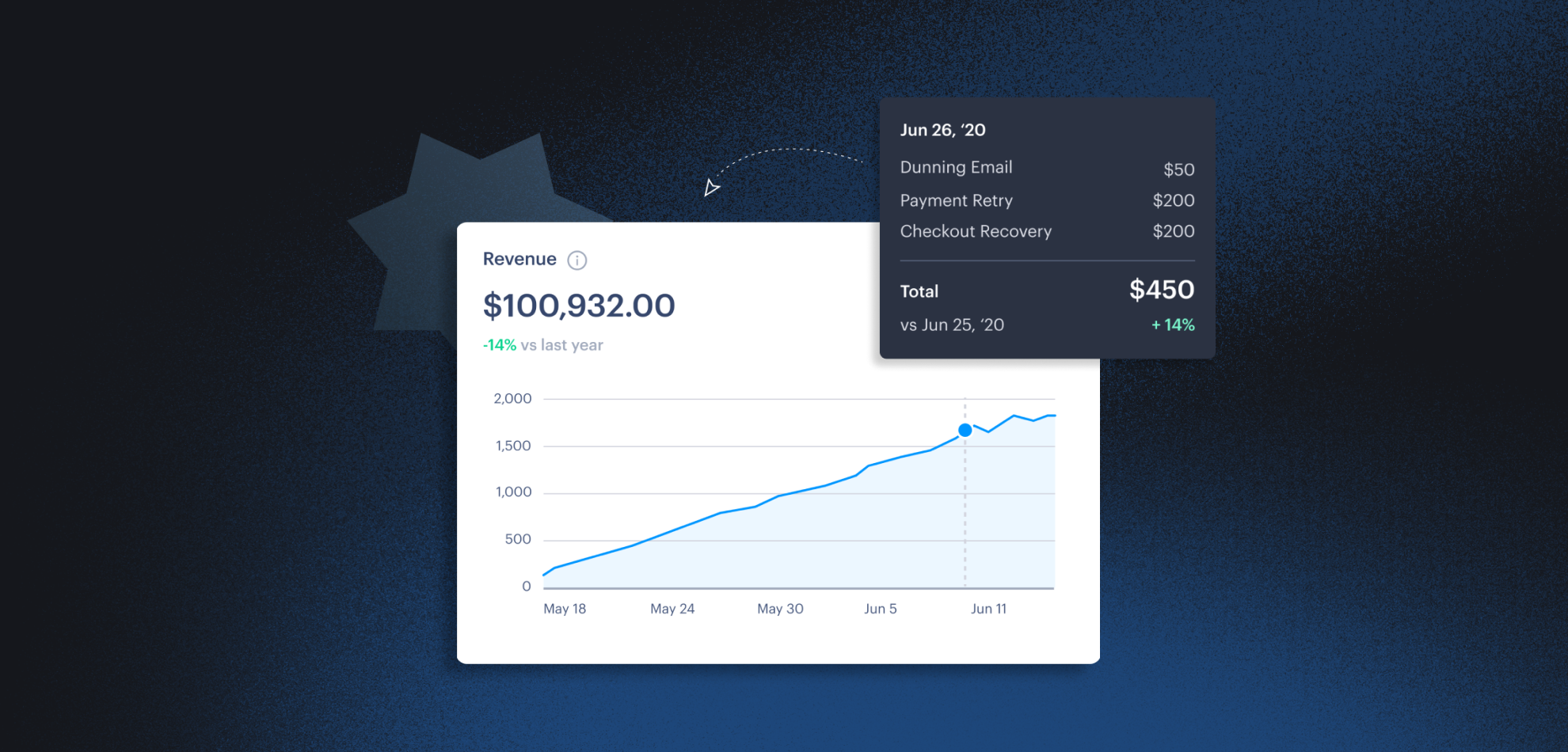

- Unified revenue data: All your revenue data, in one, easy-to-use platform to help you respond to market fast

- Stellar managed support: Always on hand to help your customers with any queries or issue to save you time

- One simple cost: No additional or hidden charges, like you find with 2Checkout

Paddle

Paddle is an example of a revenue delivery platform; one that ticks all the boxes above (if we do say ourselves 😇).

As a platform specifically built for SaaS, the growth goals and challenges of scaling a SaaS business model are always at the forefront of Paddle’s research and innovation. Our aim is to make you ‘growth ready’, so you’re fully equipped to expand upmarket, downmarket, internationally… and beyond. 🚀

This includes taking on the duties of a merchant of record and payment processor for thousands of software companies around the world, saving sellers precious time so they can focus on growing their business, rather than engineering payments or handling sales tax.

So, what else does Paddle take on?

Key features include:

- Subscription management: Have your recurring payments, downgrades and upgrades managed by Paddle

- Optimized payments: Build a top-performing checkout and billing process, with localization and tax compliance taken care of

- Multiple integrations: With multiple integrations, your revenue delivery infrastructure and data collection will be far more streamlined and efficient

- Dedicated support: All your customer enquiries will be handled by our dedicated customer support team

We speak to thousands of SaaS businesses about their revenue delivery infrastructure, how they can improve it, and what solution is right for them.

Option #2: Alternative merchants of record

When considering other options to 2Checkout, you may want to look at more direct (but less SaaS-focused) competitors: other merchants of record.

The aim of a merchant of record is to process all payments, taking on all liability related to those transactions. That includes sales tax, ensuring payment card industry (PCI) compliance, and honoring refunds and chargebacks. In other words, a merchant of record acts as the seller for business transactions, and takes on all the responsibilities.

But, how do they compare? Let’s take a look.

Here are some of the main alternative merchant of record platforms to 2Checkout:

FastSpring

FastSpring is a MoR platform, serving physical and digital goods, specifically geared towards ecommerce, though it’s recently expanded to offer more support for SaaS.

Without a sole focus on SaaS, platforms like these can struggle to keep up with the fast pace of change in the software world. Although FastSpring’s core features include the whole shebang of subscriptions, tax, payments, invoicing, and anti-fraud, these features are predominantly optimized for physical goods.

Similarly to 2Checkout, subscription management is not made easy. For those looking to upgrade (or downgrade), you will have to create different paths manually to update your system.

Oh, and if you’re looking to leave FastSpring, just like 2Checkout, the company often complicates the migration process, and sometimes even refuses to share your customers’ subscription data with you.

In short: FastSpring offers a range of payment methods and affiliate networks, but with their split focus between SaaS and ecommerce, FastSpring lacks important features, like flexible subscriptions, that fast-growing B2B SaaS businesses need.

Digital River

Often seen as more of an old-school and B2C-focused MoR platform, Digital River now actually refer to themselves as “headless commerce” meaning more flexibility for its users, to some degree.

This way of working allows for brands and retailers to compete with the big dogs like Amazon, and for more customization (on both the customer interface and the back-end), but this has its downfalls.

Enabling more customization comes with more implementation and integration work for your engineering team. Undoubtedly their favorite use of time, right? And with software companies, additional integrations really are essential when platforms aren’t focused on the complexities of SaaS billing and reporting.

You've also got the older, legacy product features of Digital River which can be limiting for more modern and fast-paced industries like SaaS, including less flexible subscription models. But one of the biggest drawbacks is the slow buyer and seller support. Any technical issues with Digital River are your problem to resolve if you want to fix something quickly. This can be particularly tricky when you have limited time and resources.

In short: Whilst a good option for B2C businesses, Digital River unfortunately lacks the support needed for B2B SaaS companies, particularly the complexities of SaaS billing. Most Digital River SaaS executives that we talk to have found and integrated additional tooling for managing SaaS-specific reporting.

Cleverbridge

With multiple billing models on offer, Cleverbridge proves itself as a top competitor for merchant of records platforms. This also leads to more flexibility for its users to configure their pricing page layouts which - whilst customization is limited - is handy.

The downside is that these adjustments (as well as any additional integrations) do need to be done manually, and as with anything that isn’t automated or ‘part of the package’, this requires time and money to engineer.

Customer support isn’t seen as Cleverbridge’s strongpoint either, with comments being made about their slow (or lack of) customer care, as well as overcomplicating the migration process if you choose to go with another provider.

In short: The customization for pricing page layouts is undoubtedly a plus-point for businesses of all types, but it comes with the hard work of managing and maintaining integrations.

PayPro Global

Similarly to 2Checkout, PayPro Global is open to a broad range of customers in the digital product sector. These customers can make the most of a good range of payment options, as well as payment routing.

But, by using an ‘open-to-all’ platform like PayPro Global and 2Checkout, you face the potential (and aforementioned) issues of your business being considered in the same feed as high-risk categories, which can lower performance.

For customers that are after more complicated or customizable services, PayPro Global might not be the right option, with limits placed on what you can and can’t do with your subscription models and checkout process.

These restrictions aren’t reflected in their prices either, with PayPro Global being one of the highest charging MoR platforms out there. Sellers are charged $1 in addition to 4.9% per transaction which, as you can imagine, adds up quickly.

In short: For B2C businesses who have engineering resources that are dedicated to your billing stack, PayPro Global is a good choice. However, the subscription models will need significant advancements for any B2B SaaS businesses, adding to the - already high - PayPro Global fees.