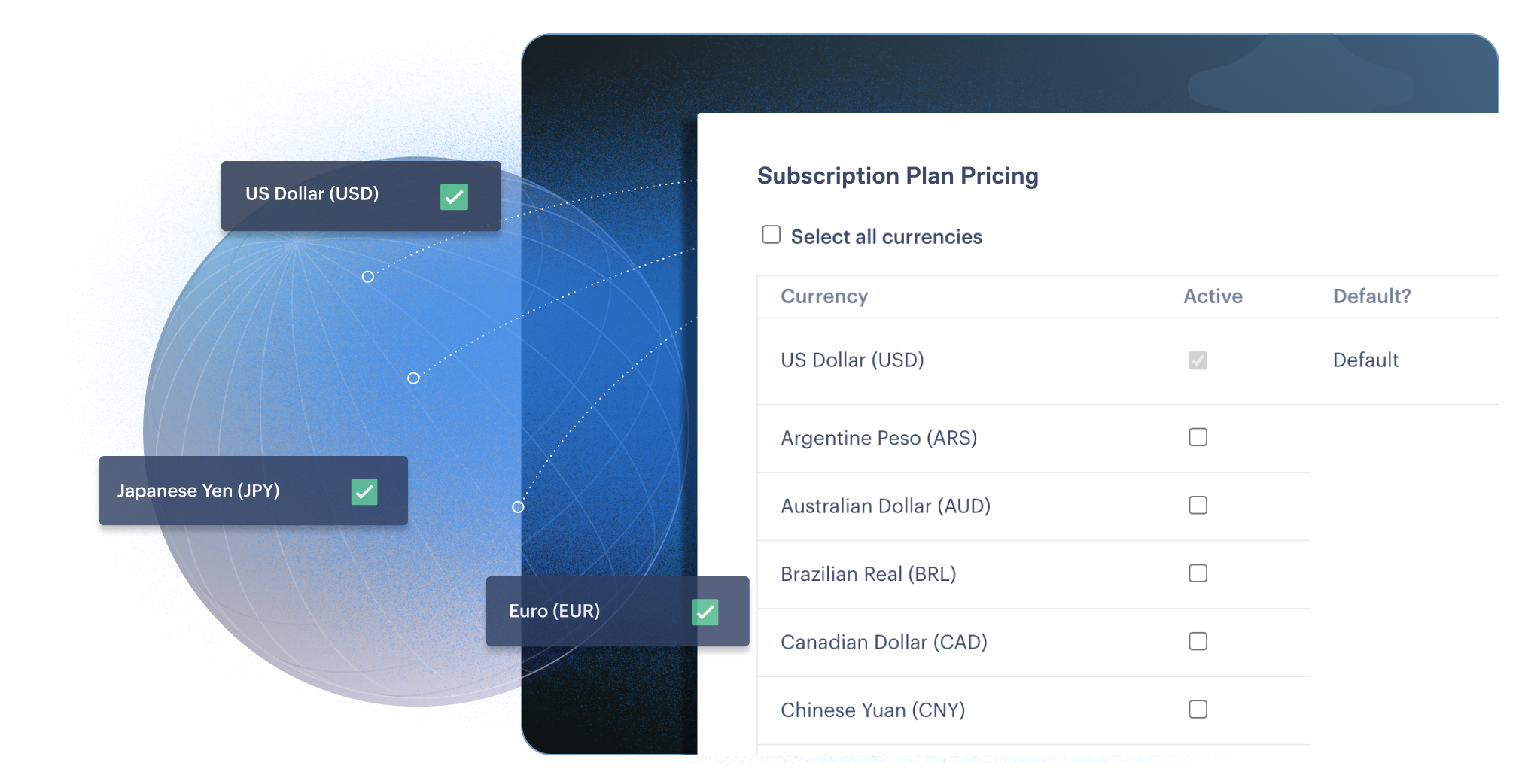

We have 67 global bank accounts so you don’t have to

Partnering with a merchant of record like Paddle frees your team from the distraction of building a global payments infrastructure, so you can focus on building your customer base.

Better

Land & expand customers with modern SaaS experiences

Faster

No slowdowns to build, maintain, and fix your payment stack

Cheaper

Avoid add-on fees, overcharges, and wasted resource

Safer

De-risk your payments with a more reliable infrastructure

What is a merchant of record (MoR)?

An MoR is paid by your end customer and handles all of the payment infrastructure and tax liability related to each transaction.

We’re incorporated and have a local bank account wherever you need one. We’re registered to collect and remit taxes. We’re integrated with all the popular local payment gateways.

You’ll get all of the above without losing control over your customers and product.

Why is Paddle the right model for you

Paddle uses the proven MOR business model and applies it to a modern, fast-growing payment infrastructure. For the best of both worlds. So you can have complete confidence in your payment partner.

The bottom line: less time maintaining a legacy system, more time growing with a reliable, modern Merchant of Record.

Paddle can help you get there

As a merchant of record, we help you get to your end goal - whether it’s funding, acquisition or listing.

We have a portfolio of public listed companies with over 1000+ employees, as well as stories of acquisitions happening every month (including Kaleido).

And if funding is on your horizon, Paddle help you prove commercial viability and growth potential to any investor with a clean, integrated, open, and auditable platform.

The results speak for themselves…

As an MoR managing the payments stacks, subscriptions, sales tax, and more on behalf of over 3000 software companies, we have found that sellers who move to Paddle usually see:

- 35% lower cost of revenue delivery

- 25% higher payment acceptance rate

- 20% improved Net Revenue Retention (NRR)

- 100% Tax and regulatory compliance in every jurisdiction you sell to

Futureproof your business

- Data and customer portability in the event you choose to leave Paddle.

- No micro charges or hidden fees.

- A partner who will fight chargebacks and fraud to protect your revenue.

A growth partner

- Guidance, strategies, and insights from our expert SaaS advisors.

- Highly-rated support for both your team, and your customers.

- Put volume through a platform that optimizes every dollar, at every step.

Integrate a reliable, modern system

- Don’t inherit your provider’s tech debt.

- Avoid rebuilds, workarounds, and hacks caused by legacy systems.

- Mitigate risk with payments infrastructure that’s optimized for B2B SaaS.

“Paddle has really helped us scale. We just didn’t need to worry about sales tax liabilities surfacing in the due diligence process, that was a huge benefit to us."