Why SaaS businesses choose Paddle over Stripe

From quicker growth and faster go-to-market strategies to simplified pricing and global tax compliance, find out why SaaS businesses are choosing Paddle over Stripe.

Paddle is a complete payments infrastructure platform

Paddle provides an all-in-one payments solution for software businesses, catering for payments, subscription billing, sales tax compliance, fraud protection, revenue recovery and more.

Stripe is a payments processing platform

Stripe's software and APIs enable companies to accept payments, send payouts and manage their businesses online.

All your payments infrastructure needs in one platform

With Stripe, you get a payment gateway that enables you to take and manage payments.

With Paddle, you get an all-in-one platform that covers all aspects of payments infrastructure, including:

- Checkout

- Payment processing

- Subscription management

- Pricing optimization

- Localization

- Tax compliance

- One single source of truth

- Advisory team

- Managed support

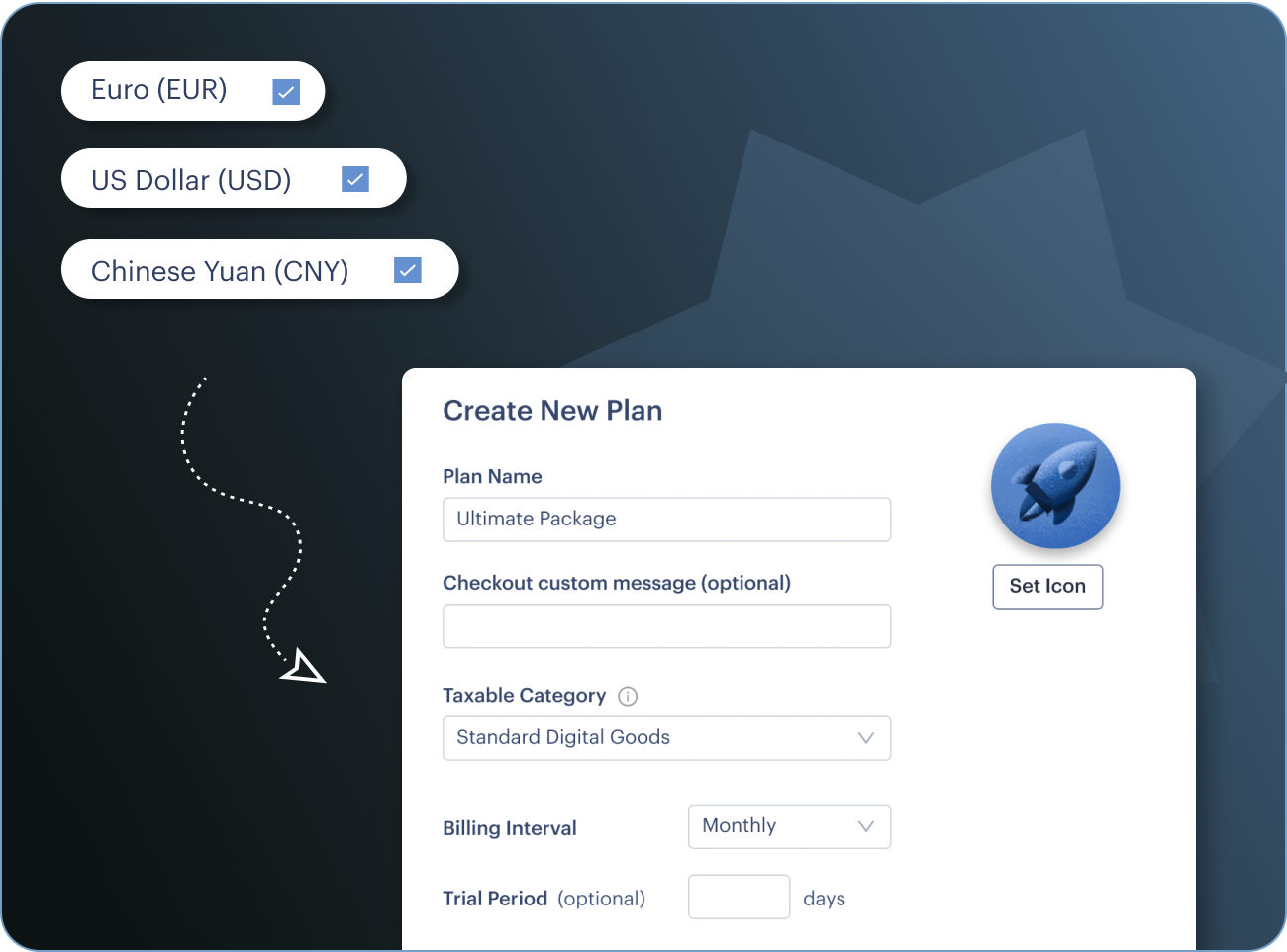

Scale quickly without overworking your engineers

With Stripe, your developers will need to integrate and maintain all the necessary tools to support your subscriptions, taxes, invoicing and SaaS metrics - or build your own all-inclusive tool.

Paddle’s all-in-one solution frees up your developers’ time so they can focus on your product and help you scale quicker.

Go-to-market faster with Paddle

Stripe solves one piece of the payment problem for SaaS, but your go-to-market strategy goes beyond payments.

With Paddle, you get all the resources, support and technology you need to boost your revenue across the entire payment process and each customer lifecycle.

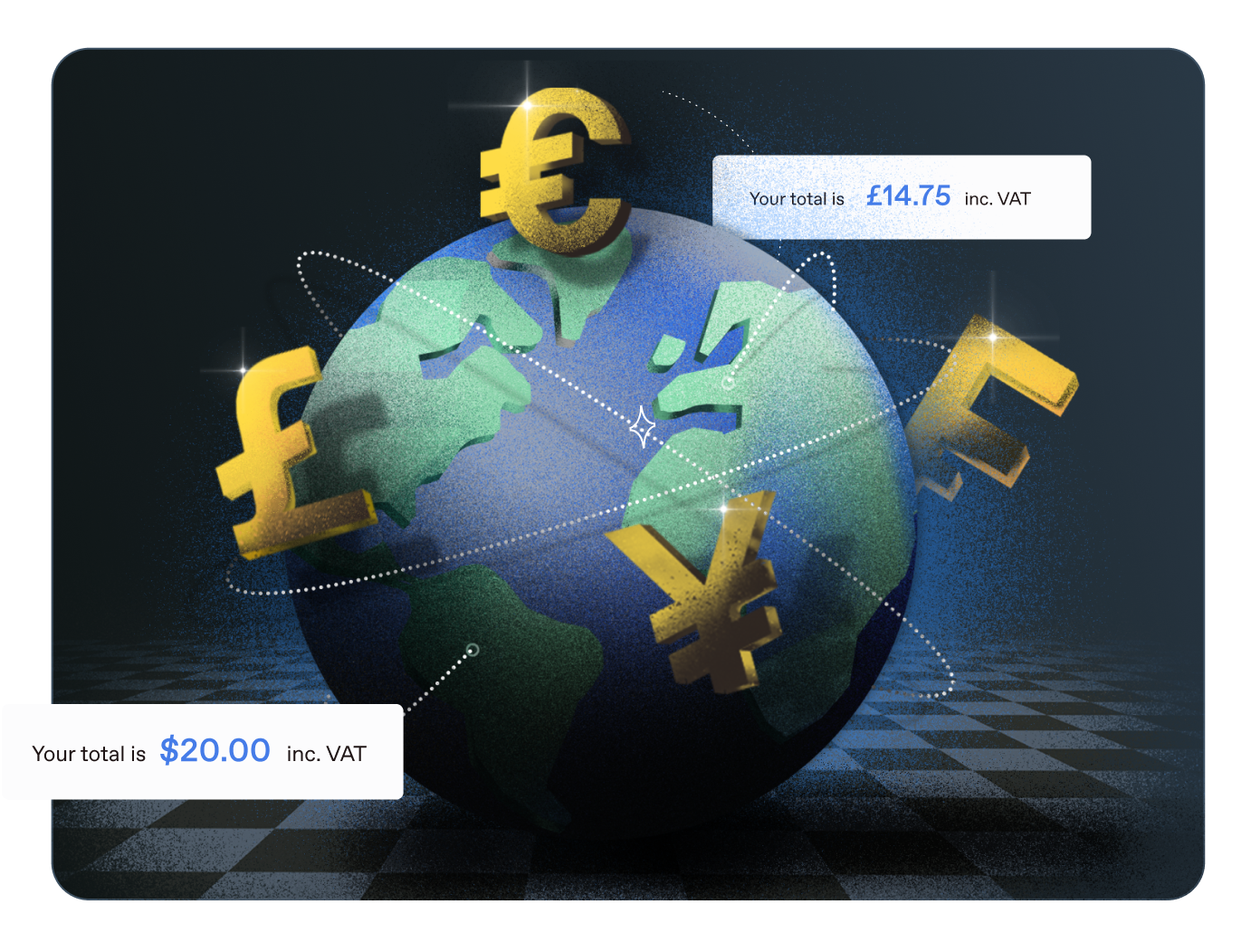

Global tax and compliance

Stripe Tax automatically calculates sales tax rates on your transactions, but you remain liable and still need to file and remit your own taxes.

As a reseller, Paddle handles tax and remittance globally, taking full liability for sales tax, fighting fraud, chasing chargebacks, managing reconciliation and ensuring compliance along the way.

Simplified pricing from the start

Stripe not only charges extra fees to access its fully-loaded payment stack, but also requires you to add additional tools to manage payments infrastructure and tax, so you end up paying much more than the advertised 2.9% fee.

Paddle offers all of its payments infrastructure features as part of one simple tool, which means just one set of costs to manage and reconcile.