Choosing the right Avalara alternative

Find the best Avalara alternative for your business and customers. Why businesses look for an alternative and the best solutions on the market.

What is Avalara?

Avalara is a specialist tax compliance software that businesses use to manage sales tax. It can be used to calculate, file, and remit taxes for businesses in both electronic and hard copy formats.

Who is Avalara good for?

Avalara caters for various business sizes and models, including:

- B2B

- B2C

- Physical product sellers

- Digital product sellers

Avalara is best for businesses with the resource in-house to manage evidence and reporting in the event of an audit, as ultimately sales tax liability lies with the seller.

Is Avalara good for a SaaS business?

By definition, cloud software is borderless – anyone, anywhere should be able to access it. But selling SaaS compliantly is not that simple. It means having to be registered in every jurisdiction your customers are located in. And with each jurisdiction comes a new set of tax rules and obligations.

Fail to observe them properly, and you run the risk of big penalties (we would know 🙄 ), trading sanctions, and even criminal proceedings.

Avalara advertises itself as a global platform but in practice it falls short of this promise:

- While it has a separate platform for the US market, you’ll incur extra charges for filing and paying taxes in each state.

- For the EU, Avalara puts an additional fee on registering for VAT.

- Outside of the US and the EU, sales tax can only be calculated, but not remitted. That means you’ll be paying another provider to submit your tax returns for other countries you operate in.

Check out our Tax Agony index - and see how some of the countries - namely India, Russia and Australia - have some of the highest penalties for incorrect tax filing.

And as mentioned, Avalara doesn’t take on the liability of sales tax compliance. So if anything goes wrong, it’s your business that the tax authorities will be calling. And no one wants that phone call, do they?

Another thing to consider is that your sales tax doesn’t exist in isolation, and neither does your sales tax software.

It’s merely one part of a wider revenue delivery infrastructure, which is also made up of subscriptions, billing, payments, currency transfer, and reporting. Avalara has none of these capabilities, so you’re going to have to buy and integrate other software for these tasks. More on that below.

Five reasons why SaaS businesses look for alternatives to Avalara

Here at Paddle we speak with over 200 SaaS founders and executives each month, who are looking for a tax compliance solution. We also spend over $165,000 on sales tax compliance ourselves, so we know the challenges of SaaS sales tax compliance pretty intimately.

Here are the top five reasons we’ve heard from SaaS businesses on why they seek an alternative to Avalara.

1) Avalara doesn't take on your sales tax liability

So we’ve already mentioned this one, but it’s worth repeating: even though Avalara helps with tax registration, calculation, submitting returns and remittance, it stops short of taking on the liability.

If any mistakes are made, it’s your business that gets into trouble. That means there’s extra pressure to import sales data into Avalara correctly and on time. (And remember, because Avalara doesn’t handle raw sales data, you’ll need a separate platform to do this, and trust that the integration works).

That not only adds work, but risk too. The fines for corporate tax avoidance are becoming increasingly punitive, with executives now being held personally responsible too.

2) Avalara doesn't offer global coverage

If your business is only selling in the US, Canada, and EU, then Avalara has you covered – though they do charge extra for dedicated solutions designed for each of those markets and even states.

But most SaaS businesses have a global customer base. Global application is where Avalara comes unstuck. It may be able to handle the calculation part in some jurisdictions, but that’s the easy bit.

In many tax jurisdictions, it’s the registering, filing, and paying of sales tax where the real heavy lifting comes in; and for lots of countries, you’ll find yourself needing additional support to fill in where Avalara can’t help.

3) Integration with other software is needed (and is complex)

At its core, Avalara is a tax calculation tool. But, as mentioned earlier, revenue delivery is about much, much more. You’ll need other software to manage the full spectrum of tasks involved in accepting and recognizing revenue efficiently and compliantly. And each one of those tools will need to be plugged into Avalara in order to automatically feed it the sales and transaction data it needs.

Don’t underestimate the challenges of software integration - we know your engineering team won’t. It can be particularly complex when pulling in data to calculate sales tax, this is because of how many variables are at play; the type of product, the price, where it’s sold, changes to a subscription package, currency fluctuations, and the supply chain all count. And Avalara deals with none of them, expecting - instead - that all this data will be fed in from other sources.

Avalara’s APIs and supporting documentation are complicated in comparison to modern API standards, which doesn’t help. And they also don’t provide a ‘How To’ guide, so you’ll need to figure all this out yourself… or pay an expert to do it for you. 🤷

Integration is never a one-off job, either. Software platforms continually evolve, and this can impact how they currently work with other systems. Maintenance is key, because the last thing you want is an unexpected broken connection in your setup.

Many can end up reluctant to migrate other tasks to better software providers too, purely down to the time and cost it will take to configure them with Avalara, leading to missed opportunities.

4) Successful software companies quickly outgrow Avalara

Based on the previous points, it is not surprising to learn that, as SaaS companies grow, they quickly find themselves limited by Avalara.

As you grow in different markets and hit more and more sales tax thresholds, your overheads for handling the related admin grow exponentially. You’ll need to register, calculate, file, and remit in an ever-increasing number of jurisdictions and risk owing back taxes and penalties the longer you delay. The complexity of your sales tax obligations (when you see success across jurisdictions) goes way beyond what Avalara can handle. SaaS businesses at this growth stage have told us they have been forced to quickly source and employ an army of tax accountants to fill the gaps.

Growth also brings pressure from non-governmental parties who want oversight of your sales tax position - be that for internal management accounts or due diligence for audit, fundraising, IPO, and acquisition purposes. Again, Avalara doesn’t fulfill your needs here. And when you’re in this hyper-growth stage, you want to be doubling down on the inputs of success - such as product innovation, marketing, and sales - and not spending precious time managing the outcomes.

5) Fees are complex and not transparent

We’ve tried to understand how Avalara charges for its services, but we’ve been left confused (and slightly shocked) by some of the numbers.

For example, the cost of their tax calculation software depends on the transaction volume, ranging from $21,000 to $160,000 annually. On top of that, you have one-off implementation costs of $14,500. Tax returns range from $42 to $54 per each filing + a $25 - $475 activation fee, depending on the volume. And for certain jurisdiction-specific tasks, you can expect to pay more.

Alas, none of this is on their website, so you’ll need to put in a call to their sales team.

Remember that this is just Avalara’s fees at the end of the day, too. As we’ve explained, with Avalara’s limitations when it comes to scaling a SaaS business internationally, as well as its lack of the comprehensive capabilities of a revenue delivery platform, you’ll be needing to spend more to buy and integrate other software.

Choosing the right alternative to Avalara

Okay, so let’s switch gears from problem to solution. In the second half of this guide, we’re going to look at alternative platforms to Avalara for SaaS companies.

First up, let’s take a deeper look into the more all-inclusive concept of a revenue delivery platform.

Option #1: A Revenue Delivery Platform

Think about it – a SaaS business isn’t really interested in sales tax. It’s not a driver of growth. It’s a burden – financially and on their time. The more resources they spend on sales tax compliance, the less they have to invest in growth.

But it's not as simple as just outsourcing it. Sales tax is part of a complex interplay of all sorts of revenue delivery requirements, including pricing, billing, subscriptions, payments and currency.

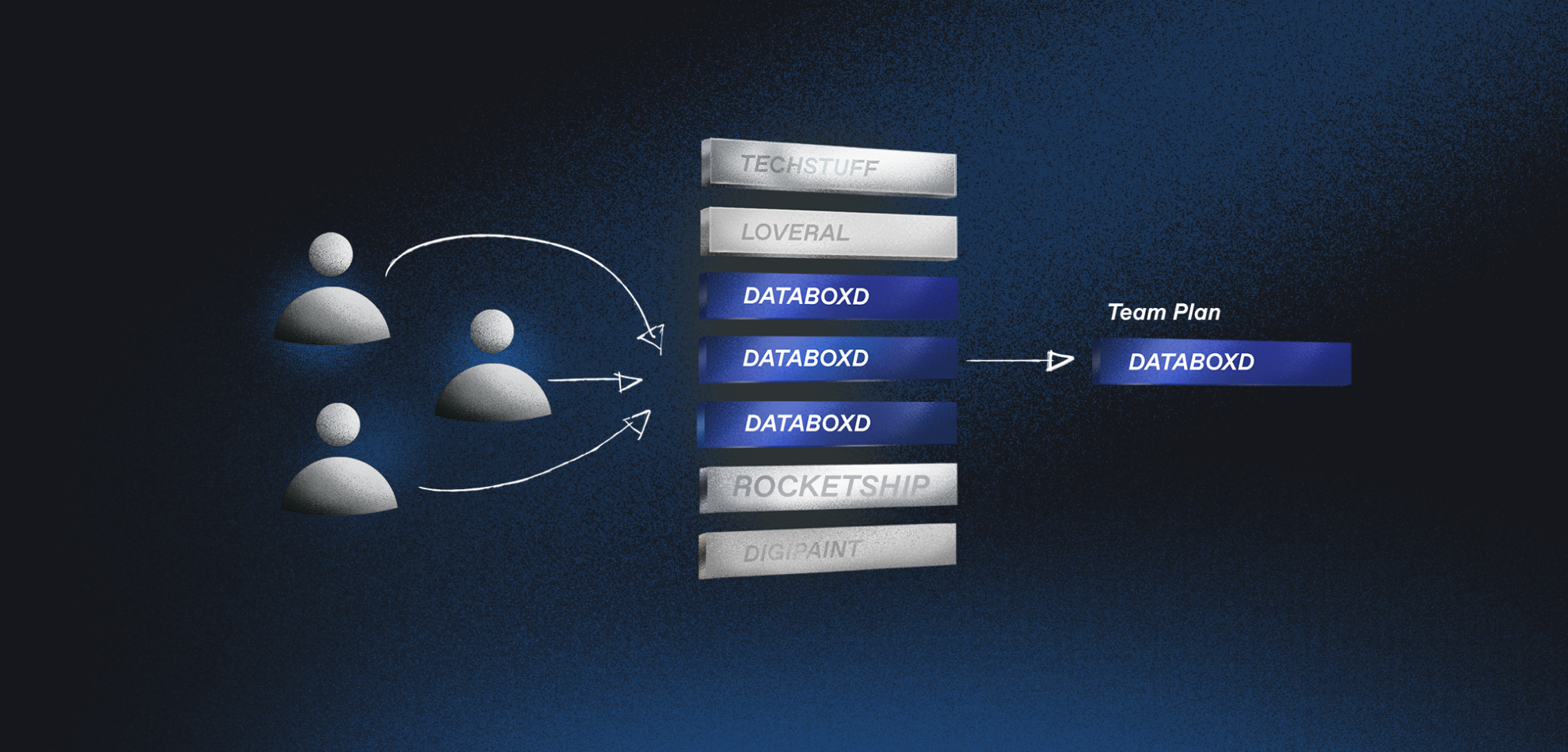

The efficient thing to do is get all of these things in one platform – so instead of being isolated functions that need to be costed and managed separately, they are cogs on the same wheel. ⚙️

This is the concept behind a revenue delivery platform. A revenue delivery platform provides all the technical capabilities and support to acquire, renew and expand customers, as well as fulfilling financial and tax obligations:

- All aspects of sales tax management, across every jurisdiction, continually updated and maintained.

- With everything under the one hood, processes can be automated, ensuring fast and accurate calculation and reporting.

- By definition, a revenue delivery platform is also a merchant of record, and it’s the legal responsibility of the platform provider (and not your business) to comply with sales tax (and other payments regulations) wherever you are selling. Handing over this headache means you can concentrate on business growth.

By opting for a revenue delivery platform, you have one system, one price, one vendor to manage. Enough said.

Paddle

Paddle is a leading revenue delivery platform, built specifically for the SaaS industry. Today we serve over 2,000 SaaS businesses, making it easy for them to comply with their sales tax obligations, while also carrying all the risk of liability.

Paddle assumes full tax liability for registering, filing and remitting tax globally. We also provide all the other capabilities that a SaaS business needs to scale globally: Checkout experience, subscription management, customer support, payments, and data analytics and reporting.

Companies selling on Paddle’s platform gain instant access to international banking networks, which enables and optimizes payments around the globe.

For example, ‘Paddle Pilot’ ensures every dollar is routed in the most effective way; ‘Paddle Checkout’ helps to maximise conversions by offering customers a great choice of payment methods, currencies and one-click payments; and ‘Paddle Subscribe’ provides a full toolkit for maximizing Net Retention Revenue with renewal, expansion and churn management features.

Being specialized for SaaS, we offer a dedicated advisory team to provide insights and recommendations for executing SaaS go-to-market strategies, whether you’re expanding upmarket/downmarket, or going international.

We’re always free to talk about how Paddle’s revenue delivery platform can support your sales tax and wider business growth needs. Get in touch and speak to an expert today.

Option #2: Tax calculators

SaaS merchants that are already using, or considering using, Avalara will likely be focussing just on their sales tax obligations.

Our advice is to leverage sales tax features as part of a broader revenue delivery platform, for the reasons we outlined in the last section. However, let’s also take a look at other straight tax calculator alternatives.

Bear in mind that, just like Avalara, none of these alternatives will eliminate your tax liability, and you’ll need to buy and integrate other software to cover what’s missing, all of which is going to slow down scalability.

TaxJar

TaxJar, now owned by Stripe (though still lacking automation between the two), offers support with sales tax calculation, filing and remittance; tax analytics reporting; and nexus analysis.

Similar to Avalara, TaxJar has an automated tax process for the US, but not for the rest of the world, and it does not cover Asia, South America, Africa and Oceania. Other limitations for SaaS businesses to be aware of is the inflexibility of its APIs, and the fact that they don’t provide guidance for integrating with other tools such as subscriptions, payments, and analytics software.

In short:TaxJar is a very similar tool to Avalara, and as a result has similar limitations for SaaS growth. It automates tax processes in the US but doesn’t support Asia, South America, Africa and Oceania.

Taxamo

Taxamo, now owned by Vertex, is a tax and payments automation tool, specialising in ecommerce and marketplaces.

Its key features include ‘Taxamo Advantage’ for self-filing and remittance; ‘TaxConexx’ for sales tax remittance by a tax specialist; and ‘Taxamo Assume’, which provides full tax liability. It has customizable APIs with Stripe, PayPal and other billing solutions, although no ‘How To’ guides for support, and so will require dedicated and ongoing developer support.

In short: Taxamo offers a product that can take full tax liability off a seller. But as it’s only one part of your revenue infrastructure, you’ll still need to integrate and manage it alongside a suite of revenue tools like payment gateways – calling for dedicated developer support.

Quaderno

Quaderno is aimed at online businesses selling physical goods, subscription services or digital products. It allows sellers to sell directly off their website, and the checkout calculates the right amount of tax based on the buyer’s location. Tax reporting is also covered, but automated filing and remittance is not. It has integrations with Stripe, PayPal, Braintree, GoCardless and some ecommerce platforms, though no support is provided.

In short: Quaderno calculates tax based on the buyer’s location and covers reporting, but not filing and remittance. It also doesn’t assume tax liability on behalf of its clients, and will need integrating with your wider revenue delivery stack.

Tax Cloud

Tax Cloud offers tax calculation, filing and remittance, with a free-of-charge tax compliance service in 25 US states. Here they offer indemnification (compensation for harm or loss), handling state notice responses to member state's tax notices, and automated filing and remittance; and integrations with various payment processing and marketplace tools.

All the above obviously sounds attractive, but only if you have eyes on these 25 states. Most SaaS businesses have more ambitious growth plans!

In short: Tax Cloud is a comprehensive solution if you only sell to buyers in the 25 out of 50 states it specialises in, but isn’t suitable for global SaaS sellers.