Choosing the right Digital River alternative

Find the best Digital River alternative for your business and customers. Why businesses look for an alternative and the best solutions on the market.

What is Digital River?

Digital River is a merchant of record (MoR) platform. It was founded in 1994, and is one of oldest MoR solutions in the market. It offers payments, fraud, tax and compliance management, and have traditionally been stronger with B2C customers. As such, some key B2B capabilities are missing or limited.

Digital River positions itself as a headless commerce solution, which means the front-end user interface is decoupled from the back-end. This allows their customers to change user-facing experiences without disrupting core commerce functionalities. It also makes Digital River more capable of working on any device. However, this requires the customer to commit significant IT resources and time to implementation and ongoing management. Digital River provides implementation support for an additional fee.

Who is Digital River good for?

Digital River has been designed for the B2C market. As such, many of their customers are ecommerce merchants and traditional ‘physical’ retailers. More recently they have been promoting themselves to SaaS merchants; and some aspects of their service do have relevance here, such as subscription billing, payment processing, and tax compliance. Digital River also offers automatic volume discounting, and product upsells from within the cart.

But is Digital River good for SaaS?

SaaS businesses have some very specific requirements, and trying to adapt a platform that has been designed for a different market is bound to leave shortfalls. SaaS merchants using Digital River may be frustrated by the platform’s lack of flexible subscription models; limitations with localizations, such as languages and currencies; and data, reporting and analytical capabilities. Suboptimal features will not be a SaaS merchant's only worry about using Digital River. Not being a SaaS specialist platform, Digital River is poorly equipped to offer strategic advice and collaborate on growth plans with its SaaS customers.

That’s why some SaaS merchants are looking for alternatives to Digital River.

Five reasons why SaaS businesses look for alternatives to Digital River

Here at Paddle, we speak with up to 20 SaaS founders and executives each month specifically about alternatives to Digital River. And we regularly migrate businesses off Digital River and on to Paddle. We’ve become pretty knowledgeable about what SaaS businesses are prioritizing, and why Digital River falls short of their needs. Here we look at five common reasons why SaaS merchants decide Digital River is the wrong platform for their business.

1. Poor subscriptions logic

SaaS businesses need to continually create and adapt different subscription packages to attract and retain customers. But subscription modelling with Digital River is inflexible and complex. It takes extensive resources to set up and change subscription models. With SaaS merchants that have time-sensitive products or lead generation campaigns, this leaves them less competitive.

Worse still, we’ve heard about Digital River delaying, or even refusing, to migrate some subscriptions to new providers. Without migrating subscriptions customers would have to re-subscribe with their payment details all over again, risking high levels of churn and revenue loss. When sellers move from Digital River to Paddle, we take care of the handover to make sure your customers don’t even notice the migration, but other providers might not offer that support.

2. Underperforming checkout

Digital River’s headless commerce offering means the user interface is decoupled from the back-end MoR commerce functionality. But it’s not all good news for SaaS merchants, especially when it comes to the checkout flow. You’ll be more reliant on developers to perform the necessary integrations and implementations; and not just as a one-off. You will need to maintain your checkout front-end, to ensure there are no breaks, new security vulnerabilities, and that software updates are performed on time. And that’s before you roll out changes that keep the customer experience modern.

You’re not just relying on developers' availability, but also having an expert in checkout conversion, as you’ll be assembling more in-house. Even a minor edit to a form can have profound consequences – and not always positive – to checkout conversion.

It’s important not to under-estimate the number of moving parts here. Digital River’s own documentation is an eye-watering read for any SaaS vendor who hasn’t quite understood the work involved.

To make life even harder, Digital River doesn't have a standard invoicing purchase flow; it only provides purchase orders through a checkout. Therefore, finance teams typically need to have other tools, systems, and processes. These all need sourcing, purchasing, implementing and maintaining too.

Help is at hand from Digital River, but not for free, and most setups and other technical support will cost extra.

3. Slow customer support

It’s one thing that simple self-serve tasks, such as creating or updating subscription packages, need technical support. But Digital River seems to confound this problem by making it hard to access the support their customers need. We’ve heard from Digital River customers that support can be frustratingly slow and inefficient. You can see this in Digital River’s Trustpilot reviews and comments.

4. Lacks specialist B2B SaaS capabilities

It’s not surprising that a platform built in 1994, designed to serve one-time purchases, falls short in the functions that a modern SaaS business needs. And will continue to do so, while they prioritize their legacy customers that still make up the bulk of their revenue.

We’ve already touched on some of these frustrations; but it’s worth recapping where SaaS merchants tell us they are underserved by Digital River:

- Limited functionality for creating flexible, variable and segmented subscription billing models.

- Digital River doesn’t support native invoicing, which makes it harder to sell upmarket. Typically a SaaS merchant will need an entirely separate finance system to handle invoicing and reconciliation.

- They only let buyers self-serve purchase orders’ through a checkout.

- Implementation and technical support comes as an additional cost, and even then availability of staff is questionable.

5. High costs

Pricing is not just about what you pay, but what you get for your money. And what we’ve been hearing is that Digital River doesn’t give value for money.

- Their pricing can range from 4.9% +90¢ on ‘blended’ pricing to 7.9% with a minimum of 90¢ on ‘simple’ pricing.

- Their reporting and subscription management functions will likely need to be supplemented with other, better tools. And remember, that with each extra tool you need, it's not just the cost of the system, but the cost of implementing and maintaining it too.

- We’ve already mentioned the extra cost of Digital River support. But roll that problem on, and the consequence is more profound. If it stops a SaaS business innovating, their own service will increasingly become outdated and uncompetitive, and more money will need to be spent on churn management and demand generation.

Choosing the right alternative

Ok, so let’s switch gears from problem to solution. In the second half of this guide, we’re going to look at alternative platforms to Digital River for SaaS companies. But first up, not an alternative vendor, but a new solution

Option #1 - A revenue delivery platform

Think about it - what is a SaaS business interested in ultimately? It’s not payments, or checkout conversion, or subscription management, or compliance. Clearly these are important, but they are just stepping stones to the end goal - growth. So, if you could get all of these things in one platform - so instead of being isolated functions that need to be costed and managed separately, they are cogs on the same wheel - doesn’t that sound more efficient?

This is the concept behind a revenue delivery platform. (If you hadn’t already noticed, Paddle is a revenue delivery platform - one that happens to be built specially for SaaS!) A revenue delivery platform provides all the technical capabilities and support to acquire, renew and expand customers. That means all aspects of selling, from pricing to the checkout experience; payment fulfillment and currency conversion to subscription management and communication. With everything under the one hood, processes can be automated, ensuring fast (or sometimes immediate) response times to opportunities and issues. Moreover, a revenue delivery platform takes on the headache of legal compliance; by definition a revenue delivery platform is also a merchant of record, and it’s the legal responsibility of the platform (and not your business) to comply with tax and banking regulations, wherever you are selling. When you consider that countries can have wildly different trading rules, outsourcing this responsibility means you can concentrate on business growth.

There are also operational efficiencies. For example, running one system means one set of data and insights, uncorrupted and easily accessible, ensuring decisions are more informed and faster to make. And it also means one piece of technology to deploy, integrate and update, and one vendor to manage and negotiate with.

Paddle

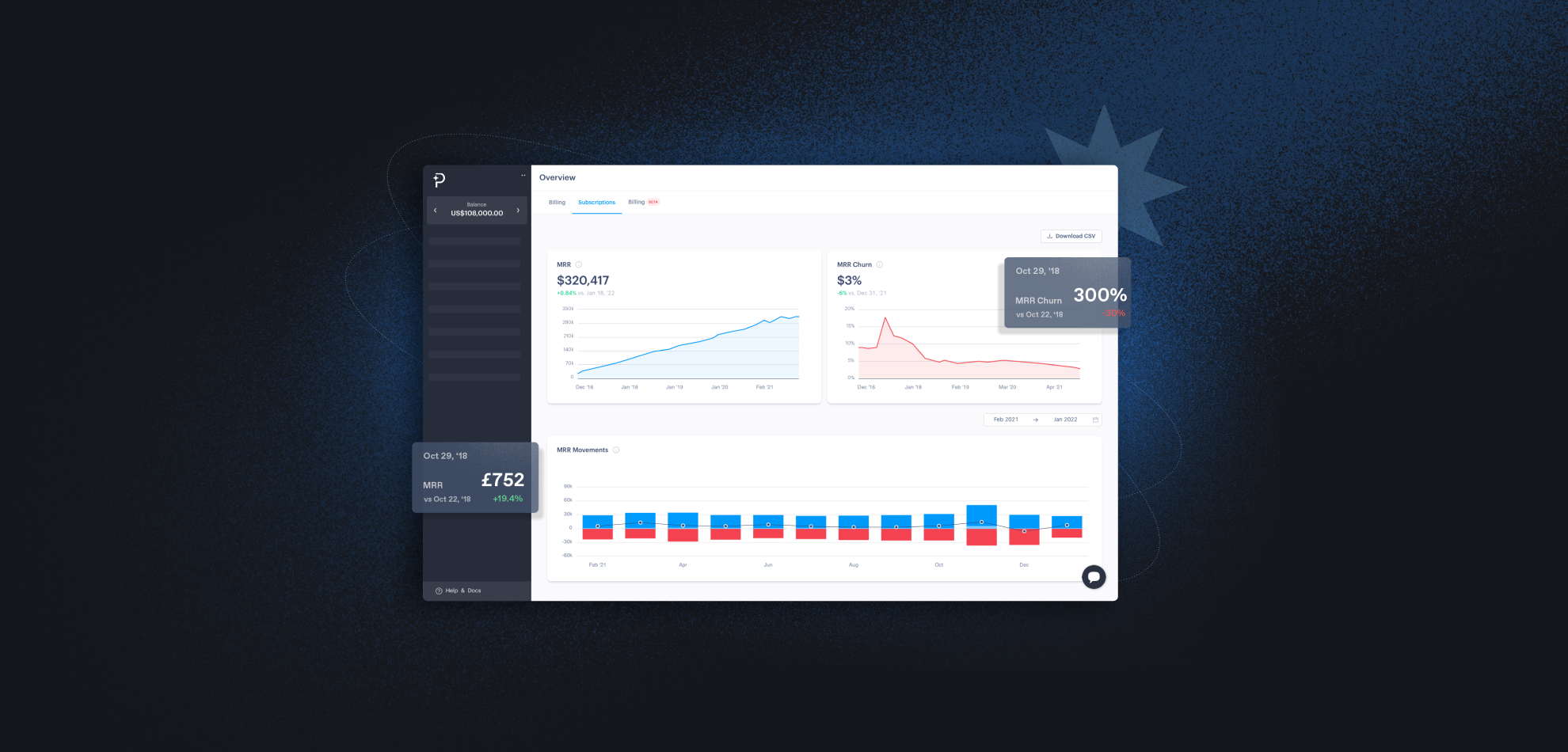

Paddle is a leading revenue delivery platform, built specifically for the SaaS industry. Paddle makes it easy for SaaS companies to scale globally, by taking on much of the operational and compliance burdens of selling subscriptions internationally. We help our customers by providing:

- Instant access to multiple acquiring banks around the world, and routing payments through the most efficient banking networks

- Local payment methods and currencies at the click of a button, ensuring end-customers can pay how they want

- Variable and flexible subscription modelling, that can be applied to different customer segments

- Optimized and localized checkout flows that drive conversions

- Management of sales tax and financial compliance

- Advice and plans for improving revenues, breaking new markets, and expanding into established ones

We’re always free to talk about how Paddle’s revenue delivery platform can support your business’ growth. Get in touch and speak to an expert today.

Option #2 - Alternative merchant of record providers

SaaS merchants that are already using, or considering using, Digital River will likely already be sold on the benefits of a merchant of record (MOR) platform. Our advice is to leverage MOR capabilities as part of a broader revenue delivery platform, for the reasons we outlined in the last section. However, let’s also take a look at other straight MOR alternatives.

1. FastSpring

FastSpring advertise their service as an "ecommerce platform". This is a broader focus than simply MoR, including the sale of physical products, which means some of their features (like shipping calculators) are wasted on SaaS sellers.

On the payments side, they offer global payment methods via partners, and also some local payment methods, PayPal, and physical checks. They also route and cascade payments. Their subscription management and billing offering is fairly standard, including a charges API-style 'managed subscriptions' where sellers trigger charges to a vaulted card.

When it comes to the customer experience, their branded checkout isn't that brandable, besides some basic colours and the ability to add a company logo. But they do have an embedded checkout and a pop-up modal.

They have risk management tools to prevent fraud and chargebacks, though this is flawed as sellers report too many 'false positives' and an unwillingness to fight chargebacks.

And having recently acquired SalesRight, they are fast-tracking a new quotes and invoicing product, which is currently in Beta phase. This will help them cater to sales-assisted invoicing flows.

In short: FastSpring has split focus between E-commerce and SaaS businesses and therefore lacks some features, such as subscription flexibility needed just for B2B SaaS.

2. 2Checkout

2Checkout was founded in 1999, and is now owned by Verifone. 2Checkout operates as a MoR for digital goods only; and offers payment processing for both digital and physical products with a selection of different packages, from core payments to additional subscription and recovery tooling.

2Checkout's merchant of record offering is called 2Monetize. This handles tax, payments and subscriptions, but is only available for digital goods. Or merchants can use 2Checkout as a payment processor only, and this extends to non-digital products. 2Sell is their basic product in this category, which allows payments with cards and PayPal, using integrated carts to handle the checkout. 2Subscribe is a specialized version of 2Sell for subscriptions with recurring billing logic.

2Checkout also offers a range of add-on features, but some of these are limited to use with 2Monetize or 2Sell/2Subscribe. These include:

- 2Convert for checkout recovery and localization

- 2Bill for creating subscription packages

- 2Recover, an auto card updater, and for improved retry logic

- 2Service for additional professional services and consultancy

- 2Partner for their affiliate network

In short: 2Checkout offers a broad range of services, and provides integrations to plug in additional functionalities, such as shopping carts. However, for SaaS companies there are specific capabilities where some functionality is missing. And this is not only a capability issue. Sometimes it can raise questions about integrity and impact payment success. Perhaps related to this, 2Checkout was suspended from processing Mastercard payments in some regions in April 2021.

3. Cleverbridge

Cleverbridge is headquartered in Cologne, Germany with offices in Chicago, Tokyo and Taipei. They provide global billing solutions for digital goods, online services and SaaS companies in B2C and B2B markets.

Cleverbridge offers more billing and subscription models than alternative MoR platforms, but these need to be manually created and adjusted, and so requires additional IT support. Options to configure pricing page layouts seem helpful, but the actual customization is very limited and can be onerous. What’s more, their customer support score on Trustpilot is very low - just 1.5.

In short: Cleverbridge requires extensive customization and the lack of implementation support makes this even more difficult. Custom pricing page layouts add benefits but again, you’ll need additional engineering resources for that.

4. PayPro Global

PayPro Global was founded in 2006, and provides e-commerce solutions designed for software, SaaS and digital goods companies. They advertise themselves as offering payments in 110 currencies and over 70 methods; and complete automation of the online sales management and optimization process.

PayPro is more geared towards B2C than B2B, with only basic subscriptions models. They have a broad range of customers, including those in high-risk categories, which can impact payment success rates for all their clients.

Though the checkout steps can be customized, the styling and branding options are lacking. Despite these flaws, their fees are one of the highest, charging $1 in addition to 4.9% per transaction.

In short: PayPro Global is more suited for B2C businesses that have engineering resources dedicated to the billing stack. The subscription models will need significant advancements for B2B SaaS, adding to already high fees and transaction costs.