Choosing the right PayPal for Business alternative

Why businesses look for an alternative to PayPal and the best solutions on the market.

What is PayPal?

Created in 1998, PayPal has a long history. It’s one of the oldest and most popular digital wallets in the world. PayPal has over 375 million users globally, uses all major currencies, and is one of the most trusted services of its kind, especially in the B2C market.

In fact, PayPal is the preferred payment method in Europe. People use it to shop online or to send money quickly to anyone with an email address. What's more, the number of physical retailers accepting PayPal is increasing. In 2013, PayPal acquired payments gateway provider, Braintree.

For small businesses, PayPal for Business offers an interesting payment processing solution. One of its main benefits is that customers don't need to have a PayPal account in order to pay you. But the downside is, you often need to set up PayPal separately from your payment platform, which adds unnecessary hassle to your workflow.

Who is PayPal good for?

PayPal for Business is aimed at businesses that need to take payments online, especially for B2C and consumers. It's typically a good fit for:

- E-Commerce businesses or online stores. PayPal supports recurring payments, which is useful for subscription-based businesses.

- Marketplaces that need to manage transactions between buyers and sellers. This happens via Braintree Marketplace, now part of PayPal.

- Mobile. PayPal offers an efficient and popular solution for your customers to pay by mobile.

- SaaS businesses

In addition, PayPal is popular in markets with lower trust of credit cards, such as Germany, as well as for lower value transactions.

Our data on sales made in Germany shows that 70% of transactions under $50 go through PayPal over card payment.

Is PayPal the best option for selling SaaS?

When it comes to selling SaaS, PayPal for Business has several benefits.

It offers the useful PayPal Recurring Payments feature, so you can bill your customers on a regular basis for physical and digital goods or services.

What's more, PayPal is the preferred payment method for B2C and lower priced B2B, especially in markets where credit cards are less frequently used or trusted. PayPal is relatively fast to set up and smooth for your customers to use. Paying via PayPal can also help improve payment success at the checkout, as it allows for multiple funding sources.

But despite these benefits, PayPal still has significant drawbacks as a solution for selling SaaS. Yes, payment processing is an important part of that workflow, but it’s only one part. Numerous other processes go into building a robust SaaS revenue delivery infrastructure.

These include:

- Subscriptions and recurring billing

- Localization (covering multiple currencies, payment methods, and languages)

- Global sales tax compliance

- Data, reporting and analytics

PayPal is purely a payment processor and doesn’t offer a solution for SaaS businesses to deliver revenue effectively and compliantly. That means SaaS businesses using PayPal will have to find ways to incorporate these additional processes, to avoid leaving damaging gaps in their revenue delivery infrastructure. This has the potential to add significant extra work in-house.

Top five reasons why SaaS businesses look for alternatives to PayPal

Every month, we speak to between 50 and 60 SaaS executives who are looking for alternatives to PayPal for their revenue delivery infrastructure.

Based on insights from these in-depth conversations about all aspects of revenue delivery (1161 calls, to be precise), we've put together a summary of the top five reasons that software executives look for PayPal alternatives. These challenges reach beyond SaaS and are also relevant for other types of online businesses.

Reason #1: Complex integration of PayPal and multiple other tools

It's important to keep in mind that PayPal is simply one part of your revenue delivery infrastructure. To handle subscriptions and recurring payments, you'll need to integrate additional tools. That situation can get complicated fast. PayPal doesn't make the process easy, with its complex APIs and documentation.

For purposes of global tax compliance, you'll also have to integrate your payment processor with tax solutions. These tend to have little to no documentation on how to integrate with PayPal transactions.

PayPal is also a bad fit for B2B buyers, as they need additional payment methods and sales-assisted invoicing processes. As PayPal doesn't offer these, to meet the expectations of larger business customers in particular, your finance team will need yet another tool integrated into your stack, as well as new processes to issue invoices and reconcile payments effectively. If you don't offer the right payment methods, your conversion rates are likely to take a hit.

To maintain high revenue performance, SaaS businesses typically need to offer sophisticated upgrades, downgrade, pausing, and cancellation functionality. This requires a subscription tool – adding yet another time-consuming integration on top of your PayPal solution.

Reason #2: Difficult to implement SaaS growth strategies

SaaS growth has a clearly defined set of strategies. These include moving into new international markets, moving upmarket to serve teams or enterprise clients, moving down-market to add trials or self-serve options, and launching new products.

As a payment solution, PayPal lacks the capability to support you with implementing these growth activities. Strategic growth generally sits outside PayPal’s main remit – payment processing.

To drive strategic growth, you’ll need substantially different infrastructure. You'll likely have to build and optimize this in-house. What's more, you'll need specific expertise on hand to guide you in creating the right infrastructure to support your product and go-to-market strategy.

Tax and invoicing form another key part of the revenue delivery infrastructure, where you’ll need additional support, especially when moving into new international markets.

Patching together a revenue delivery infrastructure from multiple tools means you don't have a single source of truth when it comes to your revenue data. This lack of a 360° perspective may get in the way of your ability to execute strategic growth activities.

Reason #3: No sales tax compliance

Getting sales tax right is critical, especially for SaaS businesses who owe sales tax according to the rules in place wherever their customers are, not just where they’ve set up shop. Even with the best of intentions, it's very easy to unintentionally mess things up. And the penalties can be severe.

As a software company, you owe sales tax where your customers are located, not where your company is based. As you can imagine, when you have customers buying from all over the world, sales tax compliance can get extremely tricky.

PayPal doesn't have the capability to deal with sales tax compliance. It's just a payment processor. It would need to be integrated with a sales tax calculator to correctly match each transaction to product and country-specific tax rules. What's more, this would need to be done correctly over the entire life cycle of all your customers – recurring payments included.

To make the matter worse, these integration processes aren’t documented. You would need to figure everything out for yourself – and tax compliance is a high-stakes game.

One alternative would be to work with a tax accountant to retrospectively reconcile transactions from your PayPal reporting. But the downside here is the sheer expense of this process. In addition, you can't charge the tax on top during a checkout, so you'll end up missing out on revenue.

In short, maintaining sales tax compliance internationally is an incredibly difficult undertaking when only using PayPal. That's why global SaaS companies are looking for alternatives to take this major burden off their hands.

Reason #4: Constrained payment performance

Having your customers pay with PayPal often looks great at the checkout. With its wide range of funding sources, PayPal offers customers plenty of options. This leads to good levels of payment success.

But on closer inspection, we’ve unearthed several of PayPal’s payment performance challenges that are likely to affect SaaS businesses.

For starters, customers can cancel their PayPal subscription payments from within their PayPal account. This creates a cancellation flow that you have zero control over. And if the customer chooses to chargeback their subscription too, PayPal usually favors the customer in this scenario. The outcome for your SaaS business? A brand-new source of churn – definitely an undesirable situation!

What's more, PayPal doesn't route card payments through multiple payment gateways. To achieve this functionality, you'll need to integrate additional tools on your own – creating more of a burden on your time and resources.

The final major issue with PayPal is its distinct lack of functionality to help you optimize your subscription retention performance. Subscription retention is the lifeblood of SaaS businesses; your bottom line will suffer if you don’t get it right.

Reason #5: The cost of using PayPal mounts up

Because PayPal’s feature set is limited only to payment processing, SaaS businesses typically must use it in conjunction with other tools. As a result, costs quickly mount up until using PayPal is no longer cost-effective.

Here’s a breakdown of some of the specific costs you can expect to find, both for PayPal itself and for associated tools:

- You'll be charged 2.9% plus currency fees for receiving payments

- PayPal charges additional fees for cross-border transactions

- PayPal also charges a fee on payout, usually capped at 2%

- As PayPal on its own isn't enough to create a revenue delivery infrastructure, you'll also need to factor in additional fees for additional tools

- Finally, you'll need a team to integrate and manage this infrastructure as well as handling your global sales taxes and compliance. This all adds up very fast!

Choosing the right alternative to PayPal for Business

We've now got a comprehensive list of reasons why SaaS businesses look for alternatives to PayPal for Business.

But what sort of alternatives to PayPal can SaaS businesses expect to find? What solutions are available on the market to address the revenue delivery infrastructure problem? And, most importantly, which one is the right fit for your business?

Revenue delivery platforms and payment gateways are the two main options for alternatives to PayPal, which can help SaaS businesses handle the above challenges. Let’s examine them both in detail.

Option 1: Revenue delivery platforms

Our research has shown us that SaaS businesses are looking for unified solutions rather than complex integrations involving multiple tools. They also want optimal performance, with infrastructure covering every step of the transaction, along with tools to help create this experience and expert advice on how to manage it.

With the many challenges of global sales tax compliance, SaaS businesses want their sales tax handled for them, removing the risk of unexpected penalties. And they want to achieve all this at a single all-inclusive cost, which also incorporates the significant value of an enhanced sales performance.

Paddle

SaaS businesses need specialized revenue delivery solutions – and that’s exactly what Paddle provides. Tailored for the SaaS industry from the ground up, Paddle combines multiple revenue delivery tools into a streamlined whole – enabling SaaS businesses to scale quickly, compete globally, and stay compliant without any of the stress.

Paddle, in fact, has Paypal integrated as a payment method, so you can easily cater to customers in markets where PayPal is the preferred option, without having to integrate it yourself.

Paddle goes far beyond just being an alternative to PayPal. Here are some of the key features designed to enhance every step of the SaaS revenue delivery pipeline.

- Managed Payments – Get instant access to established international banking infrastructure for optimized payments in every country and currency.

- Paddle Pilot – Ongoing testing process, which monitors where each dollar is routed, allowing you to operate with confidence and maximize every revenue opportunity.

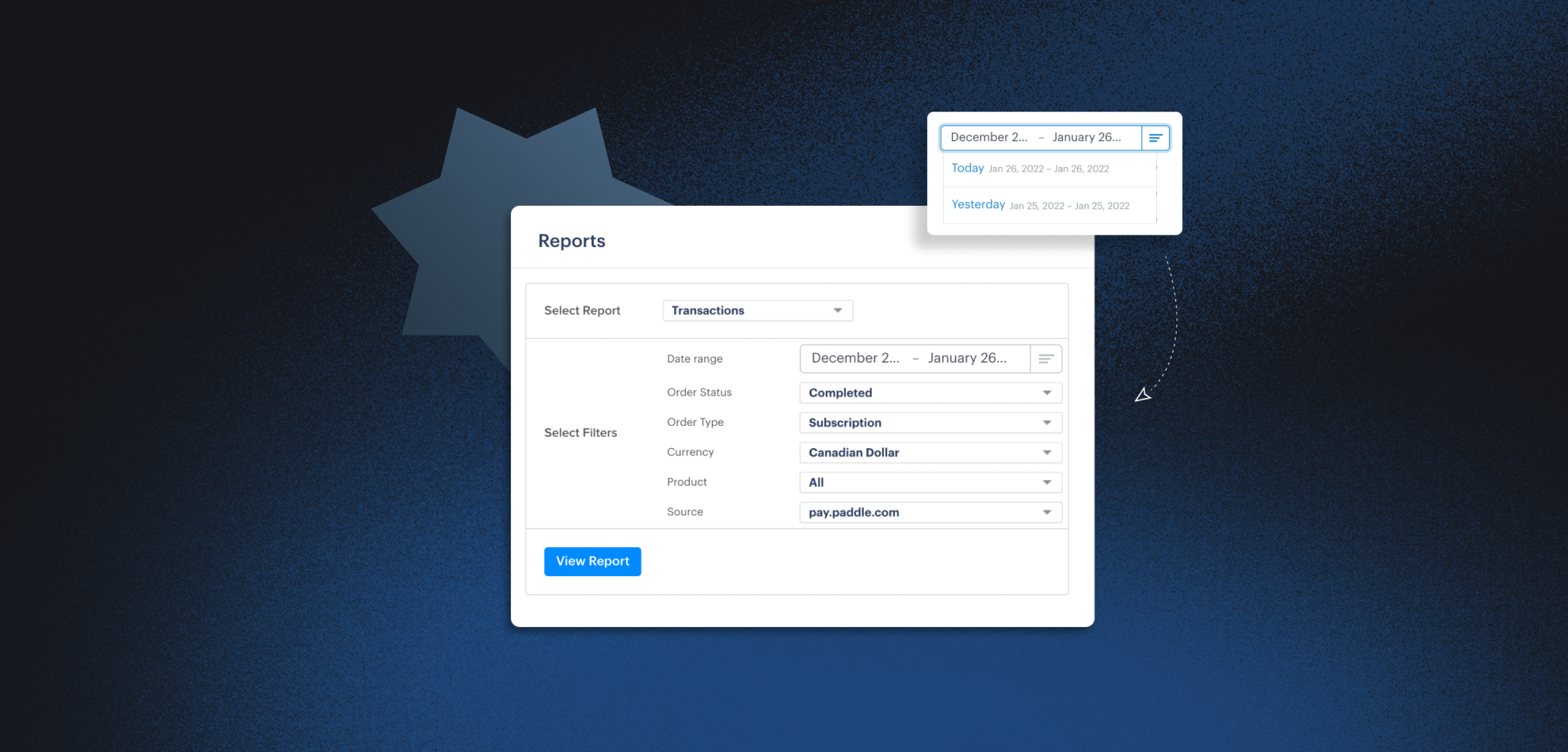

- Paddle Checkout – Offering all the most popular global payment methods (including PayPal), Paddle’s checkout service helps you to maximize conversions. With 1-click currencies and your own branding, you can tailor the checkout to your precise business needs, without all the headaches of complex engineering dependencies.

- Boost your Net Revenue Retention with Paddle Subscribe, the complete package to shape every customer’s subscription experience. Covering not only acquisition, but also renewals and expansion, Paddle Subscribe is perfectly tailored to the unique needs of SaaS businesses.

With all these advanced features, you’d be forgiven for thinking that Paddle might be tricky to integrate.

But in fact, the Paddle platform requires far LESS work to set up. As a revenue delivery platform, it covers a range of functionality and payment methods that you’d otherwise need to integrate on top of PayPal. But even if you just use PayPal, Paddle’s APIs are simpler and easier to use than PayPal’s own ones. Paddle comes with a comprehensive set of development tools, including the Paddle.js checkout, subscription APIs, and web hooks for delivering data.

With Paddle, you get a complete revenue delivery platform that not only includes PayPal, but goes far beyond it in optimizing your entire revenue delivery process.

Paddle has been serving over 2000 SaaS businesses for almost a decade, delivering a host of SaaS-specific features along a product roadmap designed specifically for the SaaS industry.

Our dedicated advisory support team partners with your business to provide insights for your go-to-market strategy – whether that's expanding up or down market or taking your business global. Get in touch and speak to an expert today.

Option 2: Other payment gateways

When searching for an alternative to PayPal, you may also want to consider various payment gateways. These offer a like-for-like alternative to the PayPal service, enabling businesses to accept payments online.

But there are several drawbacks to keep in mind. Most payment gateways present similar challenges when it comes to revenue delivery for SaaS businesses.

Because payment gateways only handle one part of the revenue delivery process, you’ll likely have to invest significant time and resources to integrate additional tools into your overall revenue delivery pipeline.

For example, if you work with subscriptions and recurring payments, you'll need to build supporting infrastructure around your payment gateway. That comes with added costs that soon mount up far beyond the cost of the payment gateway itself.

What’s more, SaaS businesses tend to have specific growth strategies, and payment gateways aren’t necessarily equipped to support them. Growth is the core of your business, so, once again, you’ll need additional supporting infrastructure to handle it.

Sales tax compliance is a big headache for SaaS companies. That headache won’t go away when using a payment gateway – especially if you serve customers all over the world.

With those caveats in mind, let's look at some of the major payment gateways, and find out how each one fares as an alternative to PayPal.

1. Stripe

As one of the most popular payment providers, Stripe allows businesses to take payments online. It’s suitable for businesses of all sizes selling physical and digital products via subscriptions or one-off payments.

Key features of Stripe

- Includes functionality for integrating payments and approving or declining transactions.

- Ability to connect your ‘acquiring’ bank to the customer’s ‘issuing’ bank, with no need to set up a separate merchant account.

- Developer-friendly API, which makes Stripe easy to integrate with other tools in your revenue delivery pipeline.

Disadvantages of Stripe

- No integration with PayPal, so you’d have to set up and manage both tools separately. Their functionality and data would be permanently siloed, making it more difficult to get a clear overall picture of transaction performance.

- Lack of buyer support beyond the basics; you’ll be on your own when using Stripe

- No capability for handling sales tax compliance around the world – so you’d still need to spend significant time, resources and energy on handling this tricky area.

In short: Stripe is a valid alternative to PayPal for Business, offering a similar set of features. However, it's impossible to integrate the two tools together, which is a major downside. You'll need to run them alongside each other.

What's more, like PayPal, Stripe is only one small part of the revenue delivery pipeline. You'll still need to find other ways to deal with customer subscriptions and localization challenges, as well as the burden of sales tax compliance regulations.

2. Adyen

If your SaaS business serves enterprise clients, Adyen could be a good fit. It's an enterprise focused payments company with a powerful set of payment features.

Most of Adyen's customers are well-established businesses, with dedicated engineers to manage their payment and billing infrastructure.

Key features of Adyen

- Offers extensive documentation and various APIs for flexible integrations (including PayPal)

- Offers flexible fees according to the volume of your payments

- With its own banking license, Adyen can offer powerful payment options, such as routing and retries, for high performance.

Disadvantages of Adyen

- Setting up Adyen integrations is complex and can be time-consuming, requiring a large engineering team. Not well suited to smaller SaaS businesses or those just starting out.

- Adyen doesn’t handle global sales tax compliance, so you’ll still need to remit, file and otherwise handle any issues that crop up.

- Adrian's platform lacks the ability to route payments through other providers, maximizing acceptance rates.

In short: Adyen is a good alternative to PayPal for Business, especially well-suited to large companies wishing to optimize their revenue delivery pipelines. Adyen offers a powerful platform with extensive documentation and modern, flexible APIs, but lacks tax compliance handling and requires substantial engineering resources – making it less than ideal for smaller SaaS players.

3. Braintree

Braintree is a payment gateway for businesses looking to take online payments. Recently acquired by PayPal, Braintree offers native integration for PayPal.

This makes Braintree a good fit for businesses selling B2C and lower priced B2B. It's particularly well-suited for businesses with European customers, for whom PayPal is the preferred digital wallet.

But the main downside with Braintree is that it’s only a payments provider. For the rest of your revenue delivery strategy, you'll need to incorporate other tools to handle tasks such as subscription billing, analytics and localization, as well as sales tax compliance.

In short: Braintree is a good alternative to other payment gateways, because it includes PayPal natively. However, many Braintree users report issues with tax compliance, subscription billing, and SaaS reporting.

4. Checkout.com

This is a fast-growing payment service primarily used by midmarket and enterprise companies. Checkout.com offers a wide selection of payment methods, including PayPal. It also offers payment routing and has a transparent pricing structure.

Despite these benefits, Checkout.com is only a payment provider. Like the other payment gateways that we outlined above, Checkout.com doesn't handle any other aspects of the revenue delivery pipeline.

You'll still have to spend time and resources integrating various tools to handle sales tax compliance, data analytics, and flexible subscriptions – and paying all the fees for these different tools.

In short: Checkout.com matches PayPal in terms of the wide range of payment methods it offers. This makes it a reasonable alternative to PayPal. However, like PayPal, it lacks functionality for other key elements in the revenue delivery pipeline. It's more configurable than Adyen but still won’t cover you for essential SaaS processes, such as managing subscriptions or tackling taxes.