Stripe vs. PayPal: Which is the right payment provider for your business?

Discover the key features of Stripe and PayPal and find out how to choose the right way to manage payments in your business.

How to accept and process payments is a vital decision for any business. But for businesses selling online, it’s the difference between converting and retaining customers and falling short against the competition.

So how can you make sure you don’t get left behind?

With an increasing number of online payment providers, making online sales available to businesses of all sizes, doing your due diligence and finding the “right” provider for your business is key. What the “right” processor means to your business depends on a number of factors:

- Billing model: Whether you need to process one-time and/or recurring payments.

- Payment methods and multi-currency support: Which payment methods and currencies do your customers prefer to pay with? Which payment methods will help you capture the most revenue? And which providers support them?

- Cost: The amount you pay for payment processing services (and additional functionality like for international payments and currency conversion).

- Checkout and purchase work flows: The checkout functionality and customer experience it lets you create.

- Security and fraud prevention: What level of protection and support do you need to prevent fraud and manage customer disputes and chargebacks?

- Third-party integrations: Which provider offers integrations with the other tools and software you use to run your business?

- Customer support: What level of support are you looking for from your payment provider for your business, and your customers?

- Payout frequency: How often will you need to receive payouts from your payment provider?

Whatever functionality you need from an online payment processor, no search would be complete without taking a look at both Stripe and PayPal – two of the biggest providers in the market.

In this guide, we unpack the similarities and differences between Stripe and PayPal to help you make the right choice for your business.

What is Stripe?

Stripe is an online payment service provider, enabling businesses to accept payments over the internet. Stripe works with businesses of all sizes and isn’t restricted by product type - meaning these businesses can be selling either physical or digital goods and services on a one-off or subscription basis.

How does Stripe work?

Stripe Payments connects payment gateway and payment processing functionality to provide an end-to-end payment experience - that is, the ability to authorize transactions through a number of payment methods. Businesses can connect to Stripe through its application programming interfaces (APIs) or software development kits (SDKs). Once set up with an account, you can take payments through Stripe who then deposits the funds (minus its fees) into your business’ bank account.

Known for its developer-centric approach, Stripe has a number of additional products to enable businesses to connect some other elements of their revenue delivery infrastructure, including:

- Stripe Billing for subscription management

- Stripe Terminal for in-person payments

- Stripe Invoicing for processing invoices online

- Stripe Connect for platforms and marketplaces

- Stripe Tax for sales tax calculation

What is PayPal?

PayPal is a payment gateway, authorizing the transactions between you and your customers. It’s perhaps the most familiar to consumers, thanks to its previous relationship with eBay and prominence on well-known retail and direct-to-consumer websites.

How does PayPal work?

PayPal either integrates into your website’s checkout flow or hosts your payment pages directly. When a customer chooses to pay through PayPal, they typically use a credit or debit card, or their PayPal digital wallet to initiate the transaction. From here, PayPal processes the payment and then releases the funds (minus its fees) into your PayPal account.

The PayPal Commerce platform is used by businesses and enterprises of all sizes as a payment processor, often alongside other payment options for customers to choose from. PayPal also has other products, including PayPal Here for in-person transactions.

Okay, let’s get into it and see how Stripe and PayPal measure up against each other.

Cost

For the purpose of this guide, we are using pricing for US sellers. Some differences in pricing may apply to businesses outside of the US.

Card and digital wallet payments:

Stripe’s base fee is 2.9% + 30¢ per successful transaction (based on US businesses processing debit or credit card payments).

PayPal’s base fee is also 2.9% + 30¢ per successful transaction (based on US businesses processing debit or credit card payments).

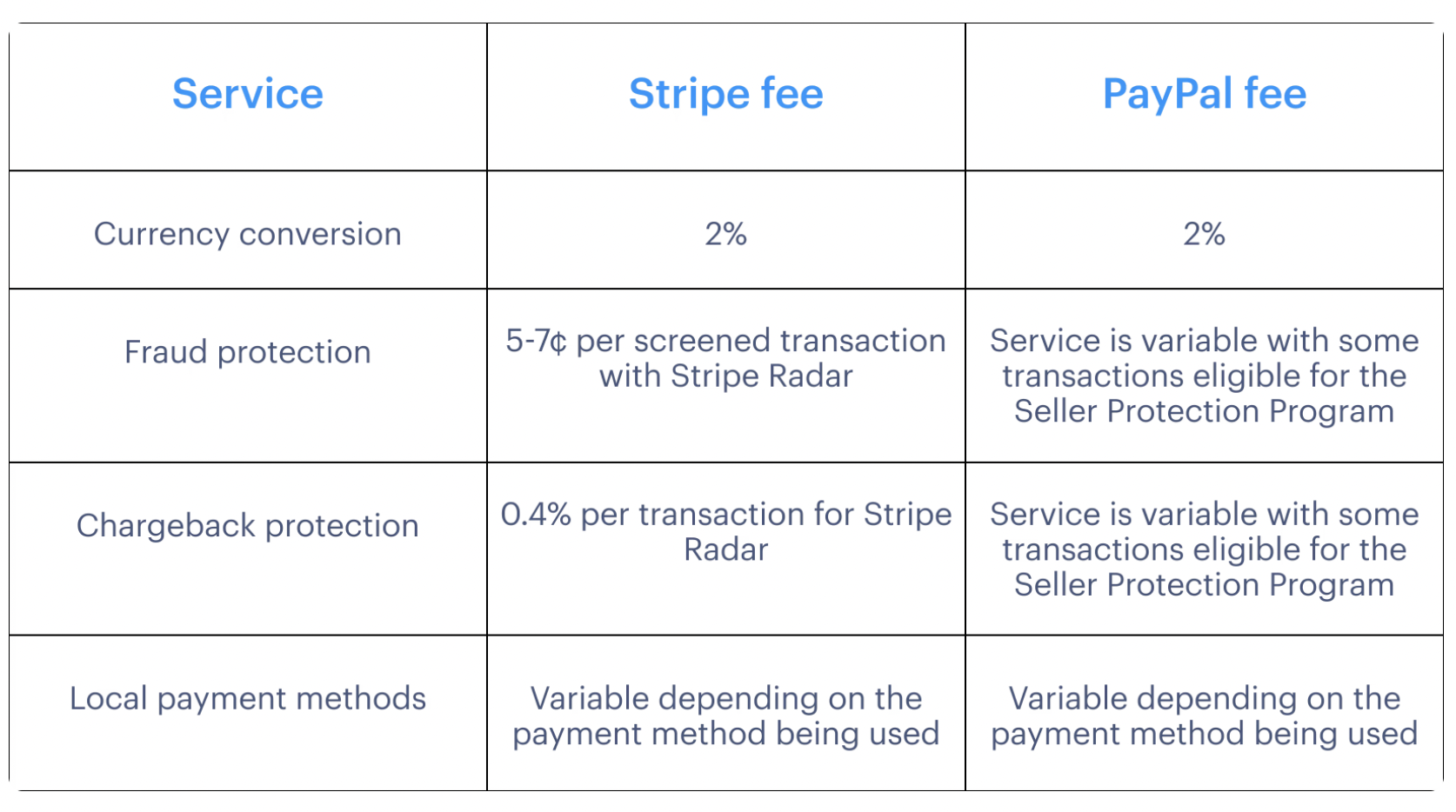

Where they differ is the additional charges for other services, including:

The fee structures for both Stripe and PayPal show why it’s important to recognize payments as just one part of your business’ revenue delivery strategy.

When you’re evaluating the cost of your payment service provider, you need to factor in how the base fees would be impacted by your business’ operations and growth strategy (for example, do you have customers internationally or are you planning on expanding to new markets?). You also need to think about the cost of any additional tools in your revenue delivery infrastructure - including subscription management software and tax compliance tools.

Payment methods

Stripe and PayPal both provide access to a number of different payment methods.

Stripe includes:

- Credit and debit cards: Visa, Mastercard, Maestro, American Express

- Digital wallets: Apple Pay, Google Pay

With access to the following payment methods, charged at an alternative fee:

- Local credit and debit cards including Discover, Cartes Bancaires, JCB, China Union Pay

- Digital wallets including Alipay, WeChat Pay

- And others including bank debit schemes, buy now, pay later providers, wire transfer, and bank redirects.

One thing to note here is that Stripe doesn’t integrate with PayPal. To use both services, you’d need to integrate with PayPal directly or an additional payment processor.

PayPal payment methods include:

- Credit and debit cards: Visa, Mastercard, Maestro, American Express

- Digital wallet: PayPal wallet/account

With access to bank-to-bank payment methods like local wire transfer and SEPA direct debit, charged at an alternative fee.

International payments

Both Stripe and PayPal enable businesses to accept international payments, with access to:

- Local currencies

- Local payment methods

- Foreign exchange on payouts

(As outlined above, some of these services are charged at different rates.)

With Stripe, you can accept payments in 135 currencies, however, the ones you have immediate access to are determined by the country of your Stripe account. This means that to charge in multiple currencies, you will need a Stripe account for each region – and some coding to integrate these with your checkout flow. This also applies to businesses wanting to receive payouts into local, separate bank accounts.

With PayPal, the process to activate and take payments in different currencies is easier but they don’t support as many.

Sales Tax Compliance

If you are using Stripe Payments and PayPal to accept payments from international customers, you will need to have tools or processes in place to make sure your sales are compliant with global sales tax regulations, everywhere your customers are based.

Stripe Tax is a product within Stripe’s product suite that helps businesses calculate how much tax to charge on transactions in 30 supported countries.

This calculator then provides the seller with reports that would then need to be filed and remitted to the authorities, either by your team, a tax accountant or another third-party tool.

Through its acquisition of TaxJar, Stripe offer an “Autofile” service for businesses in the US. Businesses looking to access this service will need a US bank account (there are also additional requirements in some states) and will still need to file and remit sales tax manually for any transactions outside the US.

With Stripe Tax, ultimate liability for sales tax lies with you as the seller. But more on the ins and outs of Stripe Tax, here.

PayPal only handles payment processing, with no direct support for sales tax compliance. As such many PayPal users would be integrating with a tax tool, like Avalara, TaxJar or Quaderno to help with some of this process.

Understand your sales tax liability with our SaaS sales tax guide.

Payout frequency

Depending on the provider and the payment method being used, payouts from your sales are made into your account at different frequencies.

Stripe offers daily payouts as standard, with some exceptions for businesses operating in high risk industries (where 14 day payouts might be required). Payouts usually include any payments that were processed 2 days prior. However, this does depend on the country, and for some markets your payouts could include payments that were made 30 days prior.

As is the case with a lot of payment providers, your very first payout takes a bit longer at 7-14 days after you take your first payment.

PayPal payouts are available immediately in your PayPal account. However, should you wish to transfer these funds to your business’ bank account, there is a 2-4 day payout time.

Security and fraud prevention

Stripe and PayPal are both Payment Card Industry (PCI) compliant. Which means they adhere to a set of standards when it comes to how they secure and protect credit card data.

Stripe product Radar offers additional support against fraud and chargebacks. Using machine learning, Radar detects patterns across your Stripe payments to assess the risk level of each. Radar also covers you against fraudulent disputes (chargebacks). Stripe Radar is a separate product, with its own fees that can be integrated with Stripe Payments. Disputes without this additional protection incur a $15 fee, only refundable if the issue is resolved in your favor.

Some transactions running through PayPal are eligible for Seller Protection. The Seller Protection Program includes account monitoring in real-time for fraud prevention purposes and further representation and protection against chargebacks. If a buyer files a chargeback request and the transaction isn’t covered by the Seller Protection Programme, you will incur a $20 chargeback fee.

Customer support

It’s important to consider the level of support you’re looking for in a payment provider as well as how easy the product itself is to use and set up.

Stripe is well known for its developer documentation and usability. Its G2 reviews reflect this too, where it’s rated highly for both ease of use and ease of setup. When there is a problem, Stripe support is available 24/7 from your account, it also offers chat support for developers.

PayPal offers customer support via instant message or telephone. It also gives users the option to ask the PayPal community. Any customers paying through PayPal will also be able to login to their own account to address transaction or account issues.

Both providers have help centres and FAQs on their website to help businesses find solutions to their problems independently.

Third-party integrations

Stripe and PayPal are both options for managing the payment side of your revenue delivery - but what about the rest of the revenue delivery infrastructure?

To effectively manage the journey of every earned dollar running through your business - from a customer’s first payment attempt, through to recurring billing and global sales tax compliance - you’ll need to integrate Stripe or PayPal with the other tools you use to run your business.

Stripe has a range of integrations, both with other Stripe products and third-party tools, including:

- Ecommerce and shopping experience software

- Recurring billing

- Tax compliance

- In-person payments

- Customer communications

PayPal has fewer integrations but does connect to different eCommerce, accounting, and customer relationship management software as well as others for business management and in-person payments.

Here, it’s best to evaluate the tools you currently use - or are considering - and see which payment provider has the smoothest integration, otherwise, it could leave your engineering team with an unexpected set of work to connect the different systems together (and then maintain the integrations).

Which is right for your business?

Stripe is commonly used by growing companies and enterprises. Most importantly, businesses that use Stripe will need to have the development resources in-house to build the integration.

For this reason, PayPal (as the sole payment provider) is more commonly a solution used by smaller businesses.

While we are comparing them in this guide, a lot of businesses actually choose to use both PayPal and Stripe together. Offering more than one payment method gives your customers the ability to choose how they’d prefer to pay, and gives your business a better chance of capturing that revenue.

Unfortunately, you can’t currently integrate PayPal with Stripe so you need to have two accounts and two sets of integrations with some of your other tools. Alternatively, you could look for an all-in-one solution that offers both PayPal and other payment methods through a provider like Stripe – without you having to integrate with either of them directly.

Whichever payment processor you choose, remember to think about how payments fit into your wider revenue delivery infrastructure. That is, the systems, processes, and teams responsible for delivering every earned dollar as revenue.