Understanding average revenue per user (ARPU) and how to grow it

Understand what average revenue per user is all about and how the metric can be used to understand and improve the performance of your business.

What is average revenue per user and why is it important?

Average revenue per user (ARPU) is a measure of the revenue generated by each user over a given period of time, taken as an average. ARPU can be used by any business, but it's more relevant for those with a recurring revenue model, such as subscription companies - SaaS in particular. In a subscription business, customers make repeat purchases of the same or similar products, and often also buy add ons or upgrades during their customer lifetime. They can also be offered discounts or free access, or decide to downgrade. All of these events impact the average revenue per user. This is why tracking ARPU over time can be used to indicate growth and make projections.

As a standalone metric, ARPU can be misleading. It can rise - a seemingly positive indicator - even if you are losing customers and overall revenue is falling. To see the full picture, you need to look at ARPU alongside other SaaS metrics, notably customer and revenue numbers in real terms.

ARPU matters more to some SaaS businesses than others. For example, a startup using discounting to attract customers may be OK with a falling ARPU if it’s as a result of new signups (i.e. more customers, each paying less). But at some point, they will want to rebalance from subscriber growth to revenue growth. Here, ARPU becomes more important, and if they aren’t able to grow it (or at least keep it stable) the business will not be sustainable.

ARPU can also be used to prompt a change of course. For example, if your business keeps attracting new subscribers and revenue is growing, but ARPU is stable, it may point to your product being underpriced. So too if your ARPU is less than your cost of acquiring new customers. That means you are losing money on every new customer, which may prompt you to target a different (more profitable) demographic or explore new marketing channels and tactics.

The difference between per user and per unit

A variation on ARPU is to look at ‘units’ instead of ‘users’. Average Revenue Per Unit looks at how much revenue each unit of a product line is generating. It is often used to understand how much discounting on the list price has occurred, and is especially relevant if you are selling in bulk. Average Revenue Per Unit is more common where businesses are selling tangible products, as opposed to pure SaaS businesses that are, by definition, selling services. That said, older technology companies often retain legacy hardware products in their portfolio, so they will want to analyze ARPU on a ‘per user’ and ‘per unit’ basis.

How to calculate Average Revenue Per User

ARPU is calculated by dividing total revenue by the number of users during a period. The period is usually a month. For example:

Total revenue $500,000 per month

Total subscribers 50

ARPU = $10,000 per month

ARPU is not a Generally Accepted Accounting Principle (GAAP) requirement, and therefore it can be calculated in different ways. In the next section, we’ll look at some of the factors that might influence how you calculate ARPU.

Variables to control for when calculating Average Revenue Per User

One of the criticisms leveled against ARPU as a metric is that it is too general. To combat this, it’s best to analyze ARPU by specific segments, so that you calculate it in a way that makes sense to your business. Here are some of the parameters you should think about.

The user

Clearly, how you define your ‘user’ is going to change the ARPU you get.

- Paid vs free: Not every user pays, and some will be paying less for the same service.

- Accounts vs seats: Often SaaS businesses will provide an account with multiple seats to access their service. There is one subscriber, but many users.

- Active vs dormant: Some users are more enthusiastic about your service than others. Some may not have logged in for a long time. How do you decide who to include?

- Integral vs peripheral: Some users - such as early adopters, influencers, key decision-makers or project leads - will have value beyond their revenue, and conversely may bring in less revenue as a result.

- Length of service: Loyal customers who may be expected to have a higher ARPU could be dragged down by new customers that are not yet ready to spend big with you. You may want to keep these groups separate.

How users pay

Some SaaS products will charge incrementally to consume more of the service, access new features, or add more users. While some will rely on a pay-as-you-go model, making spending patterns more unpredictable than a subscription model.

How users consume

The other side of ‘how users pay’ is how they consume a service. Some SaaS businesses have fairly stable consumption patterns - for example, business productivity applications and music streaming services. Others will expect users to switch on and off (e.g. holiday apps, digital tax submission). While some services are designed to scale at a moment’s notice (e.g. cloud cybersecurity solutions).

The time period

ARPU is often measured by month, as this is when most subscription payments are taken. But it may be more relevant to look at ARPU in a shorter time frame (i.e. weekly or even daily), or longer (i.e. quarterly or annually) - depending on how regularly the service you are providing is used, when renewals take place, and how agile you need to be in the marketplace.

What is a good Average Revenue Per User?

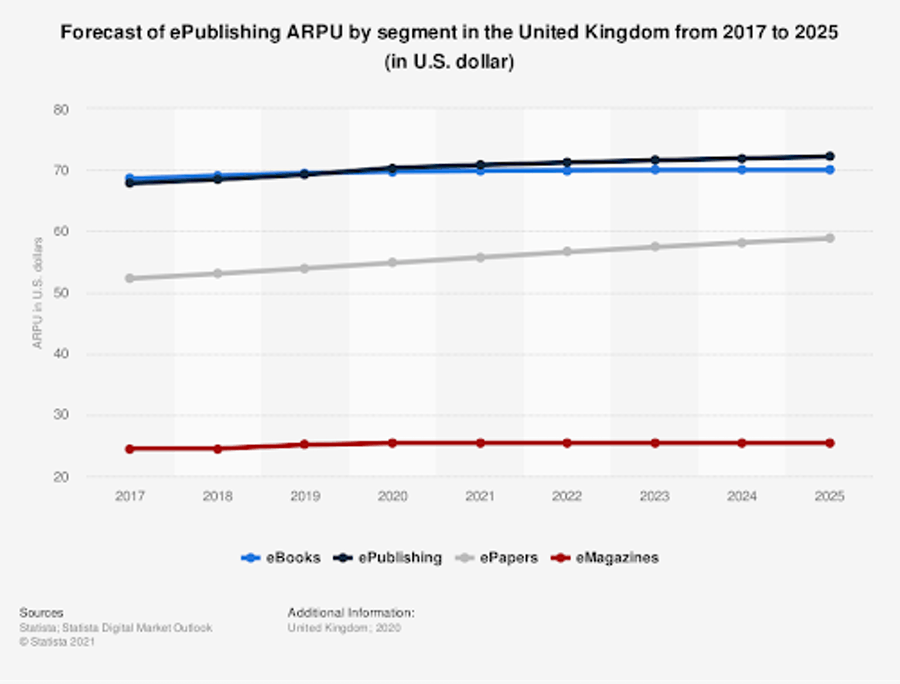

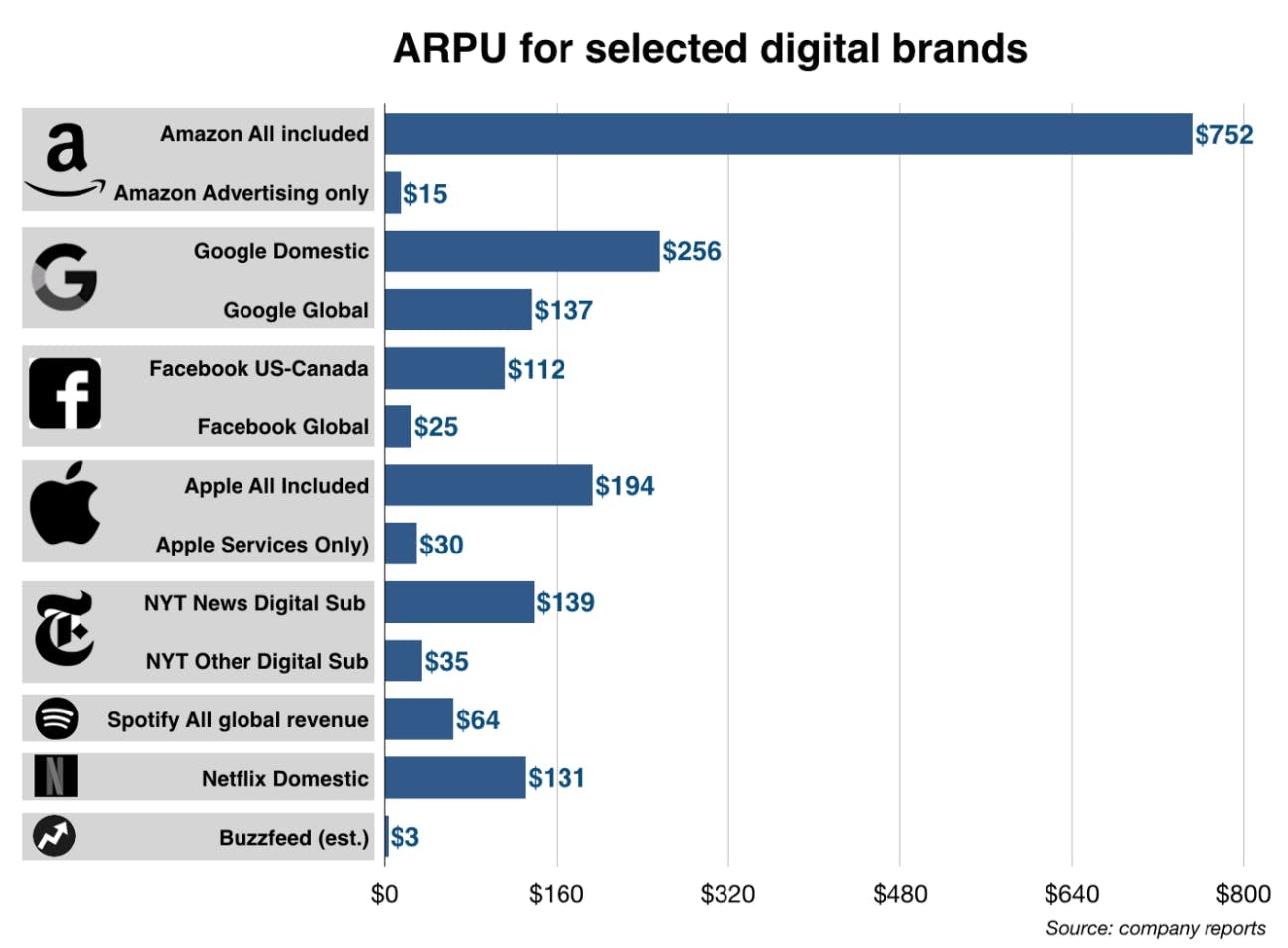

Unlike some other SaaS metrics, ARPU is an actual number, not a rate. Therefore, broad industry benchmarks can be unhelpful. But be careful to make sure you don’t end up comparing yourself to businesses with very little in common, or ones that have different priorities to yours. Here are some examples of how ARPU benchmarks can fluctuate.

By country

By market segment

By product or user segment

Source:Mondaynote.com, 2019

Three ways to grow Average Revenue Per User in your business

(Source: Mondaynote.com, 2019)

Three ways to grow ARPU in your business

There are two basic approaches to growing ARPU. The first is to get more lucrative customers. The second is to get your existing customers to be more lucrative. Here are some ways to achieve that.

1. Focus on quality, not quantity

Not every user is desirable. Those who don’t spend much will bring down your ARPU and curtail profitability. Actively ending their custom with you (or introducing terms that make access prohibitive) is a good place to start. But you’ll also need to replace them with the right type of customer. Define who that is, and then activate targeted marketing to attract them (and not others). Remember to keep an eye on customer acquisition cost (CAC), to ensure your new subscribers turn profitable in the expected time frame.

2. Get more from who you have

There are lots of ways of getting customers to spend more. The easiest is to raise your prices while keeping your service affordable and competitive. New product features present new revenue streams; as do ancillary services such as technical support and training. Sometimes, simply re-communicating the benefits of your offer can encourage more use and a wider footprint with a customer.

3. Price it right

Raising your fees isn’t the only price tactic you can employ to grow ARPU. Moving customers to different price plans - for example, charging by consumption or seats - may be a less contentious way of making more revenue from each.

How a unified payments infrastructure supports ARPU growth

How a unified payments infrastructure supports ARPU growth

Timing and ease can be two more reasons why a subscriber may be willing to move plans, pay more, or buy more. The flipside of this is that revenue growth is lost when customers can’t do what they want when they want. Operationally, there are many moving parts to executing these tactics: from being able to segment customers and prospects, to communicating to them via the most effective channels; making checkout as smooth and secure as possible, to surfacing and acting on real-time data.

All this is made harder when you have multiple systems, each running specific tasks. Conversely, a unified payments infrastructure - that covers subscription management, payments, and data analysis - allows for significant automation, flexibility, and speed.