How to calculate (and reduce) your churn rate

Too often, SaaS businesses are failing to accurately calculate their churn rate - or even consider it at all. We tell you how to calculate churn properly, how important the metric is for your business, and how to reduce it.

Churn is often a very undervalued metric, especially within SaaS businesses that are just starting up. We’re here to tell you exactly why every business should be taking their churn rate into account, how to calculate it accurately, and how to reduce it.

What is churn?

Churn is a SaaS metric and term used to describe customers that stop doing business with you over a certain period of time. The customer churn rate of a business is the percentage of customers who don’t renew their subscription, intentionally or not. It is also used to calculate the amount of revenue lost from those customers.

It’s an essential metric that can determine your business’ long-term viability, while drawing out extremely vital information about your wins and - more urgently - your losses.

Why is churn so important?

Churn is a super important metric for businesses, because it can point you to what’s going right, what’s not-so-right, and what’s very wrong with your business model and its processes.

A low churn rate in a subscription business means customers are happy with the value you’re delivering. A high churn rate, on the other hand, could mean that you’re failing to fulfil the promises you made to your customers.

The faster a customer churns, the less amount of revenue you will have earned from them. If a customer churns quickly, you may find that you spent more on acquiring them in the first place than they ended up spending with you. Not ideal.

Are there different types of churn?

There are two main types of churn to consider

Customer churn

The number of customers who didn’t renew their subscription in a given period of time

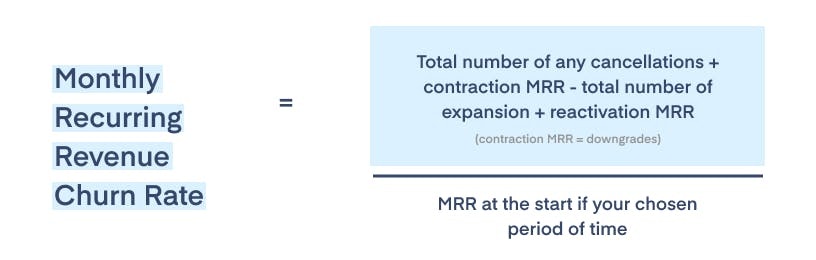

Monthly recurring revenue (MRR) churn

The amount of recurring revenue lost in a given period due to people either downgrading or not renewing their subscription.

Customer churn can also be broken into two different varieties: voluntary and involuntary. More on that later.

How to calculate churn

Too often, we find that SaaS businesses are measuring their churn rate all wrong.

They’re either getting stuck on the reporting front or they’re choosing to ignore the churn rate metric completely, meaning they aren’t getting the clear picture of how sticky their product or value proposition really is.

Don’t let that be you.

Here is how to calculate your churn rate:

Four variables to consider when calculating churn

Even if your mathematically gifted brain finds these formulas a piece of cake, there are complexities to understanding churn that you need to take into consideration when you run these calculations.

1) The differences between B2B vs B2C

B2B and B2C companies deal with churn slightly differently, mainly down to the fact their target audiences (and their behaviors) differ:

B2B SaaS businesses often have a far more niche target audience and business model, normally with strong specifications in mind. They typically experience a relatively low churn rate, due to factors such as higher prices, specialized accounting departments or services to deal with B2B churn, and annual subscriptions

The world of B2C is far broader meaning it can be harder to attain (and retain) each customer’s attention, particularly with all the competition in similar markets. They typically experience a higher churn rate than B2B, and greater competition within their industries.

2) Not all churn is intentional

Sometimes, churn has nothing to do with how happy your customer is with your product or service.

They might be sat there minding their own business, unknowingly having their card declined. This could be thanks to weaknesses in your revenue delivery infrastructure causing poor payment routing, or something as mundane as the customer’s card having expired.

This is known as involuntary (passive) churn. Unlike voluntary (active) churn, customers who churn involuntarily aren’t looking to cancel their subscription; they would have stayed! So unless you recover them, it’s simply money down the drain.

It’s so important that you focus on both areas of churn if you want your business to succeed - which is what every business owner wants, right?

3) Pre-churn vs post-churn

You also need to classify your churn strategies by considering how to re-engage users based on pre-churn events and post-churn events.

Say what?

Well, ideally you want to catch the customers that are either wanting to cancel or involuntarily cancelling through payment failures in a pre-churn scenario. That way, it’s easier to avoid or at the least reduce the chances of them leaving.

Whether you butter up your near-voluntary churners with top customer service and support to keep them happy, or whether you make sure your payment acceptance is on fleek for all users, make sure you get on it before the subscription renewal date.

But, all is not necessarily lost if you’re a bit late in the game and the churn has already happened. You can still shoot your shot with cancellation offers or the opportunity to pause payments for those that need a little push (back) in the right direction. As for involuntary churners, you can look into payment recovery options such as account updaters and payment dunning so you don’t miss out on that revenue.

4) Churn rates vary by industry, and that’s okay

Know that all of the above depends on the business and service you’re offering. Some businesses will have a higher churn rate than others and be just as successful, and some will have to tackle churn in different ways.

The ‘average’ churn rate for SaaS businesses is around 5% - and we’d like to stress the word ‘average’ a little more. Av-er-age.

This can be compared to education services, for example. The average (yes, average) churn rate for this field is just under 10%. That’s down to the fact that the industry is very much seasonal – churn is affected by the school year. While 10% sounds high, in the education industry it’s considered healthy.

That said, a high churn rate can often be a strong indicator that something needs to change.

Churn rate in the SaaS industry

Churn is a particularly crucial metric for the software industry. Measuring, managing, and generally keeping on top of your churn rate will put you in good stead for business success and growth.

There’s no doubt that churn is impacted across several components that make up a business’ payments infrastructure. Think about it - customers churning (whether on purpose or not) can be down one or more of these factors:

- Payment and billing process - e.g. problems with payment acceptance like the card used to pay being expired

- Subscription management - e.g. not having flexible plans that customers can control (for example, being able to easily pause their account)

- Customer support - e.g. how your team helps and supports your customers

- Perceived value - e.g. failing to meet your customers’ expectations after they sign-up or subscribe to your service

By looking into your customer churn, it can bring up important opportunities that will help you to optimize your product to its best potential. And you know what that means? More customers and more revenue. 🏆

What’s a good churn rate for SaaS?

We know what you’re thinking - what’s a good churn rate and what’s a bad churn rate? We’ve already talked about the ‘average’, but that’s just an average. (Enough of that word now).

All businesses are different. Not all software businesses, for instance, are made for customer longevity.

Loyalty? Maybe. Longevity? Not so much. We already mentioned that the level of churn rate depends on the service you’re offering. In the world of software, there are many examples of successful business models that have a high churn rate because they aren’t made for long-term subscriptions.

One example is resume.io, a software that helps those on the hunt for a new job with resume templates, as well as a helpful job tracker tool. With the aim to help people get new jobs, there are no expectations for their users to come back on a frequent basis throughout the year or subscribe for a long period of time, creating - what comes across as - a high churn rate.

In reality, because of the model of their product, the churn rate shouldn’t be considered ‘high’ in this respect. They get the job done, so people end their subscription. And when they’re ready to start the job hunt again? Guess who’s back...

Another example - one within the realms of B2C - is the dating app, Hinge. With the slogan, “Designed to be deleted”, this app isn’t one they want you to keep and it makes no secret of that either. They want you to download, engage with the app, find your perfect match, and then live happily ever after. (Number of times you download and delete it again before the latter happens: unspecified).

So ultimately, in some cases it’s okay to churn, baby, churn 🔥

Saying that, none of this takes away from the fact that all models of SaaS businesses need to be aware of their churn rate and why customers are churning, because no one wants to be missing out on revenue unnecessarily.

For example, a business like resume.io could be losing customers because their payment process doesn’t support international payments. This, my friend, would lead to a high churn rate that needs to be dealt with.

Calculate it, assess it, find opportunities to reduce it.

So next up, the all-important question:

How do you reduce customer churn?

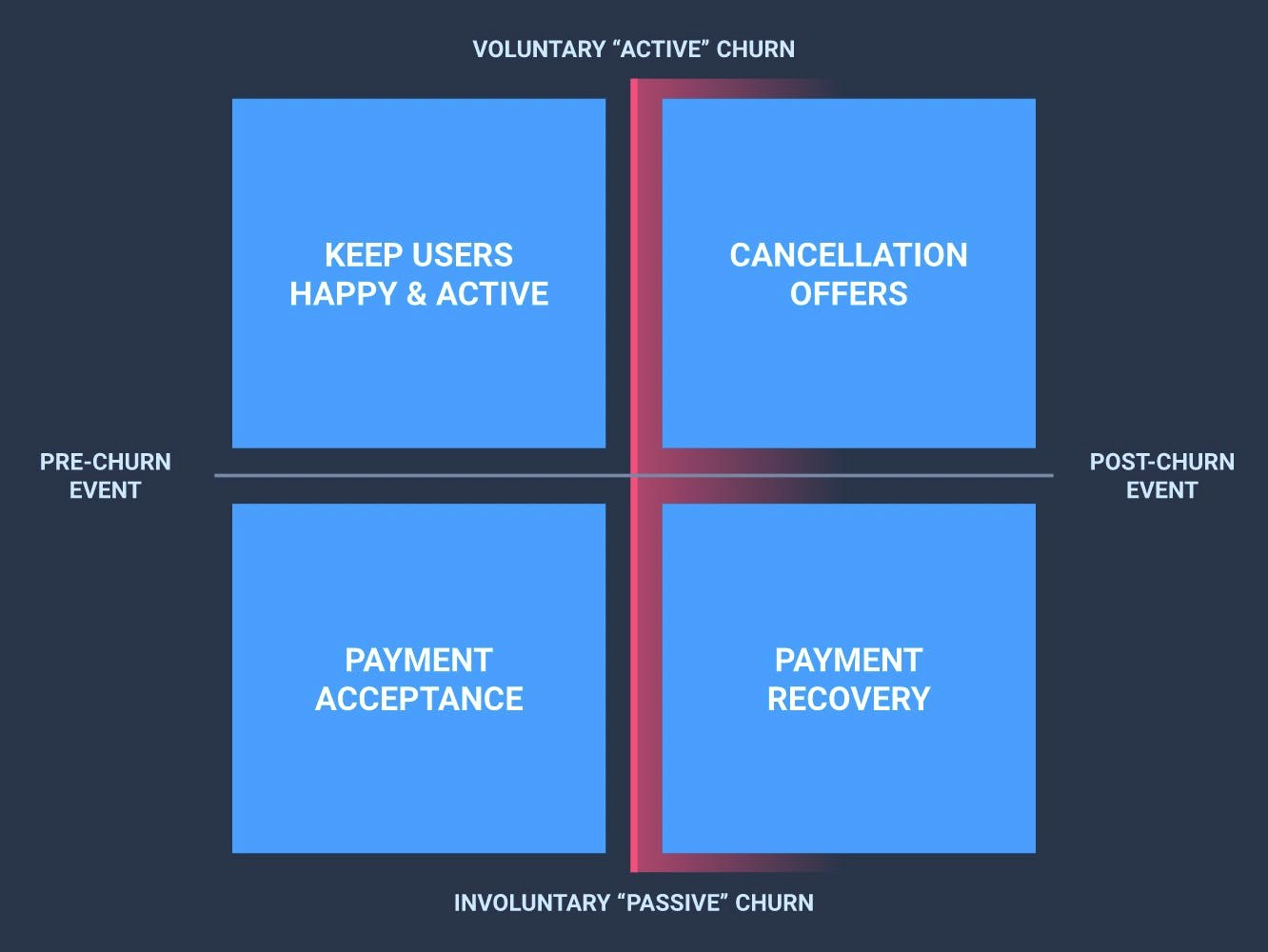

There are a number of ways you can go about reducing the churn rate of your business, and at Paddle, we’re quite the fan of this 2x2 matrix:

We're a fan of this matrix because it considers all of the main facets of building out your churn strategy. Ideally, you should build a complete churn reduction strategy that takes on each quadrant.

Breaking it down in this way makes it more tangible and helps make sure you cover all bases.

1) Keep users happy and active

While it sounds obvious, you’ll be surprised to hear how little some SaaS companies focus on their customers. Always - and we mean always - stay on top of your customer experience and customer support.

Happy customers means returning customers and loyal customers, (as well as the potential for some cheeky highly-rated reviews and recommendations along the way). It’s all about the customer lifetime value.

2) Cancellation offers

The trick: get them back before they’re gone. When your customers go to cancel, find out why and offer up an unmissable deal to deflect on the cancellation request. Think about why your customers might be cancelling, and figure out how you can change their minds.

This could be as simple as offering them the option to pause, instead of cancel their account, meaning it’s easier (and more tempting) for them to restart if they do change their mind.

3) Payment acceptance

This is where you look into your payment and billing process to ensure that subscription payments aren’t failing at points you can control, and if they are: hurry up and stop that happening.

For example, international payments can cause quite the stir for some startup SaaS businesses because their payment processes haven’t been optimized for the best chance of success. Find out more about that right here.

4) Payment recovery

This strategy is where you make an effort to recover any failed payments and fraudulent chargebacks. This can include strategic retries of payments, cascading payments, and of course, email comms to let the customer know their payment was unsuccessful.

For a more in-depth approach to (our favorite) matrix and the four main parts to every churn reduction strategies, we’ve got just the thing.

These churn strategies might sound straightforward enough, but don’t go thinking that means the effort you’ll have to go to will be simple too. There’s no denying that tackling churn takes time and effort, but breaking your approach down into these four strategies will make it much easier to tackle (and retain).