The ultimate guide to customer acquisition strategy for SaaS

Everything you need to build and implement a solid customer acquisition strategy for your SaaS business. Attract the right customers, price competitively, and convert them into users with a seamless checkout and onboarding experience.

Successful SaaS businesses implement growth strategies across customer acquisition, retention, and expansion. This is to say, they learn how to:

- Acquire more of the right customers

- Retain them for longer

- And expand their accounts or broaden the pool of customers they can serve.

This guide is all about part one of that journey, customer acquisition.

Consistently acquiring new customers is crucial for all SaaS businesses. For new startups, it’s the difference between claiming a stake in the market and fading into the background.

In this guide, we’ll unpack the customer acquisition process for SaaS, including:

- Pricing and packaging

- Conversion

- Provisioning access to your product

- And how your revenue infrastructure can support your strategy

What is a customer acquisition strategy?

Customer acquisition is the process of bringing new customers into your business. Many think of this as the moment a customer completes the checkout process and hits that “buy now” button or when a contract is signed. But it’s actually more wide reaching than that.

Customer acquisition starts with your go-to-market strategy, which steers how you sell your product, including:

- What your pricing strategy looks like

- Who your target customers are

- And how you will target them

And continues until you have converted prospects - or even free users - into paying customers that are actively using your product, thanks to a seamless onboarding experience.

Let’s take a look at each piece of your customer acquisition strategy in a bit more detail.

Perfect your pricing and packaging (and then do it again)

On average, SaaS companies spend a mere 6 hours on their pricing strategy. This might seem like enough time to price your product but in reality, pricing should be far more than a “set and forget” strategy.

If you don’t optimize your pricing and review it at regular intervals the impact can be more detrimental than you might think. It ultimately affects the rate at which you scale.

If the price is too high, you’ll outprice your customers, and charge more than their perceived value of your product. Too low and you sell yourself short. This risks your product looking like a “cheap” or, even worse, less effective option compared to competitors.

In addition to the price point, you need to think about how you package up your product offering. This might be on a subscription basis, or as a one-time purchase or you might have different tiers, with different features available at different price points.

Time to spin the wheel (or read on) and find out how to make sure the price is right.

1. Identify your target market

You can’t price your product if you don’t know who you’re selling it to.

Think about which demographics, verticals, geographies, and personas make up your ideal customer profile and do research into their buying habits. For example, how do they shop with your competitors?

2. Define your product catalog

Think about your product and how you could package it up into different features. One common approach is to offer tiered pricing packages, with a basic, standard and premium option. Others might offer product bundles or the option to make one-off or add-on purchases to a subscription.

3. Decide how you will monetize it

Your price point will depend on how you actually decide to bill your customers;

whether you’ll offer subscriptions as well as one-time payments, the length of your billing cycles, and whether or not you’ll offer promotions, or trials to encourage people to get started using your product first.

4. Price, learn, repeat

Pricing is never “done”. It’s tricky to get it right the first time and even if you do, what works when you launch, almost definitely won’t work as you scale.

ProfitWell recommends reviewing your pricing and making changes every six months, so keep listening to your customers and looking at your user and revenue data.

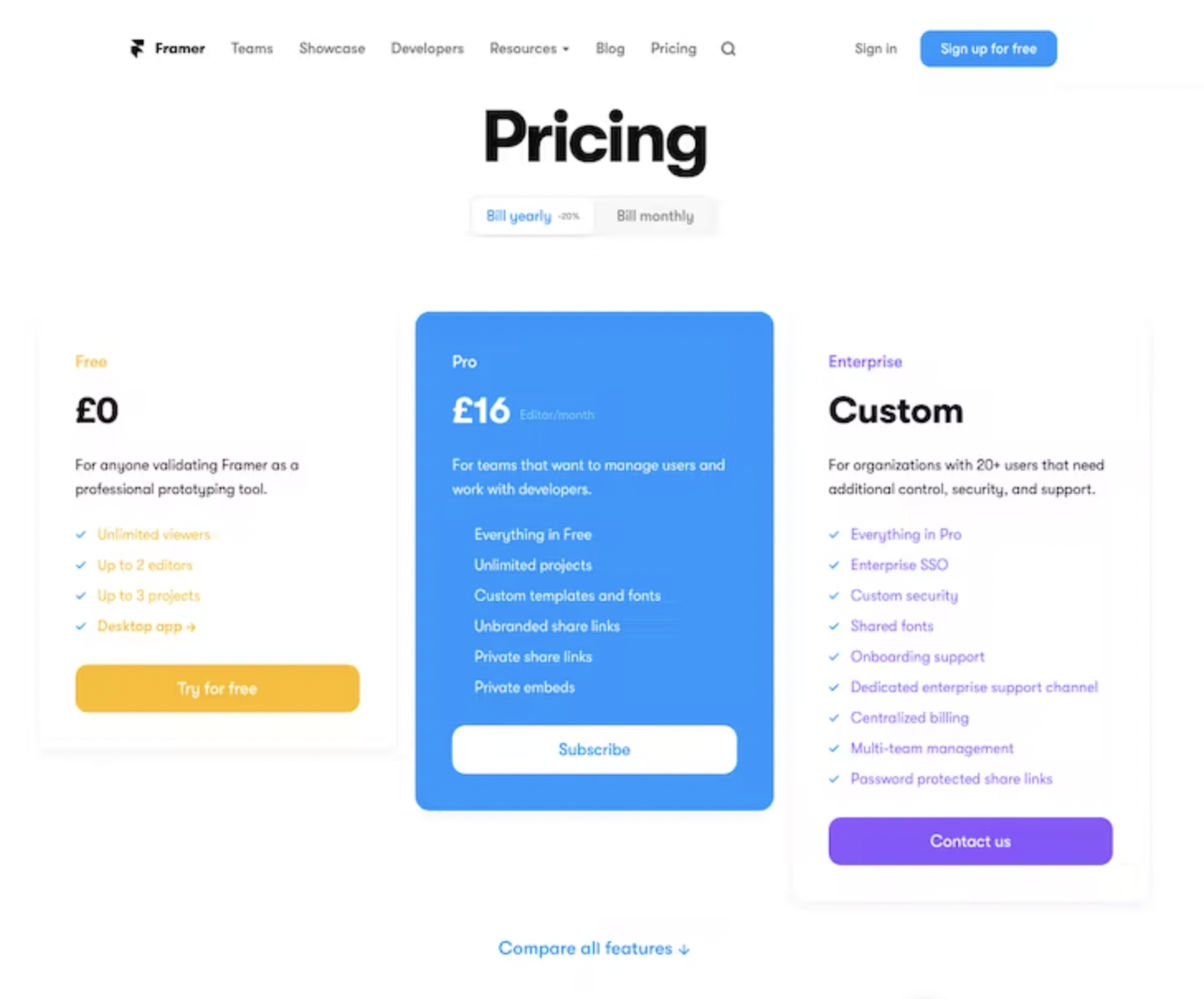

Case study: Framer’s compelling pricing page

Design software, Framer’s pricing and plans page is a masterclass for SaaS businesses. If you look at the screenshot below (or check out the live page), you can see how Framer use pricing to effectively:

- Cater to different customer segments, with different packages for individuals and teams

- Display the value from each package clearly, and concisely

- Hook customers in with a demo and trial period

- Offer flexibility in how customers are billing, with monthly and annual options (and discounts!).

Check out your checkout conversion (and secure that initial payment)

Your pricing is right on the money, and your prospects are ready to convert into paying customers. Result. 🙌

Now all you need is the checkout and purchase flow to secure that all-important initial payment. Right?

Not quite. There’s a lot that goes into maximizing these workflows for optimum conversion and it goes back to decisions about how you want to sell. Let’s get into it...

1. Determine your sales channels

Depending on your product, billing model, and target audience, you’ll use different sales channels.

If your business sells directly to consumers or to small businesses and teams you might take a product-led approach; one that allows customers to sign-up and pay through a checkout on your website. Think setting up a Spotify or Netflix subscription or buying access to an SEO tool for a couple of team members.

Companies selling to larger, enterprise-level businesses are far more likely to have a sales team, where price and contracts are negotiated before a deal is closed. For example, a business HR software, or I don’t know… a revenue platform (👀 ) that is intended for long-term, cross-company use.

Other businesses use different channels - like, selling through affiliates or using a marketplace like the app store.

You should also consider how people will get to this point of purchase or start the sales cycle. Will interesting prospects come to you as inbound sales? Or will you have a team doing outbound sales and reaching out to your ideal customers to peak their interest?

Top tip: When you’re thinking about sales channels, remember these might change too. Lots of SaaS businesses find they garner interest from larger companies as they scale – whether they intend to move upmarket or not. When this happens, how will your business respond to different sales expectations and requirements? Here’s more on this from our Chief Strategy Officer, Harrison.

2. Spread the word

So, you know who you’re selling to and how you’re going to sell to them - now is the time to spread the word about your product.

Consider the marketing channels that will help you reach your audience and the call to action that you want them to follow. In a sales-led company, this might be a call to “Request a demo” or “Talk to sales” after a webinar or on a piece of direct mail as part of an account-based marketing (ABM) campaign.

In a product-led company, this might be a button telling people to “Buy now” or “Sign up for a 30 day free trial” on a landing page linked to from an advert on social media.

3. Optimize for maximum conversion

For a sales-led company, this is where your sales team takes the stage and your processes get put to the test. For more on how to get that right, read our SaaS sales guide. 🤝

For product-led SaaS companies, this is where your purchase flow - including your checkout, payment options (methods and currencies), and any subsequent communication - has to seal the deal. For developer tools or similar products that require engineering time to implement, your developer documentation is key here too.

While it may be tempting, only offering credit card payments in USD won’t cut it if you serve customers around the world. You at least need payment methods that your customers trust, in a currency they recognize and can associate value with. In fact, our data shows that localizing the checkout in this way can boost conversions by 30%.

4. Secure that first payment

A prospect filling in their payment details means nothing if it ends in a payment decline.

To avoid this, you need to know how your payment methods and banking relationships work and introduce robust processes to give those crucial initial payments the best chance of success. This includes:

- Fraud checks that safeguard you, and your customers (but aren’t so sensitive that they see legitimate transactions declined).

- Payment method capture for those signing up for a subscription (otherwise how will you charge them next month?).

- Multiple payment methods and acquiring banks for the regions you operate in so you can route payments accordingly for the best chance of success.

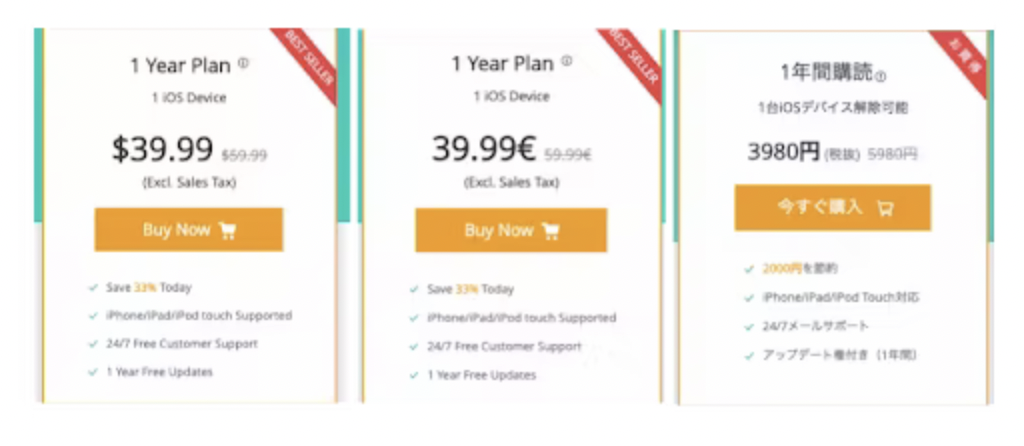

Case study: How iMobie boosted global conversion with checkout localization

iOS and Android transfer, manager, and maintenance software, iMobie is a great example of how optimizing your checkout and payment processes can boost conversion.

To tackle its low conversion rate, iMobie:

- Localized the process with geo-specific pricing, currencies, and the correct sales tax calculations.

- Implemented flexible subscriptions, with one-click upgrade, downgrade, pause, and cancel options.

- Optimized its checkout and payment page design.

And the result?

iMobie’s conversion rate improved by over 20% in Germany and France, and over 10% in Japan.

Deliver your product and its value

A prospect has converted into a paying customer, the initial transaction has been approved, so now it’s time to fulfil your end of the bargain and give them access to your product (also referred to as provision). 📥

In a traditional retail business that sells physical goods, this is where you’d be packaging and shipping those goods out to the customer. With SaaS and digital goods, this process looks a bit different.

Let’s take a look at what it involves.

1. Decide how you will deliver your product

You can provision digital access, for example, by authorising users to login and start using your product. This is common for SaaS; think along the lines of business collaboration tools like Miro or HR software.

Others provide users with the ability to download software once the purchase is complete.

Some offer a hybrid approach to this, for example with Zoom, you are given user access and can log in through a web browser but you also have the option to download a mobile or desktop app.

In other cases, it could be the delivery of a digital asset, like an ebook or audiobook, via email.

However you choose to deliver your product, you need to make sure that your onboarding process is seamless so that it’s easy for your customers to get started, and quickly find value in your product.

2. Track users are using the product effectively

Once your customers have access to the product, you need to make sure they actually use it to its full effect.You don’t want them missing out on all that great functionality you and your team have worked so hard on.

Tracking things like product or feature uptake is a great place to start, You can use tools like Pendo and Mixpanel to discover customer insights including where customers find the most value - hello optimization opportunities. 👋

If you are billing customers based on their use of the product (usage based billing), this becomes even more important as you need visibility of any overages that you might need to charge for.

3. Revoking access after it’s been granted

With a physical product, you deliver the goods and the transaction is complete. With software, you need to be able to revoke access to the product for various reasons, including:

- Subscription renewal: If you require the customer to opt back in to continuing to use your product when their subscription ends, you might need to temporarily revoke access until they have done so.

- Trial completion: Stop access at the end of a trial period, until that person chooses to continue their subscription by making a payment.

- Delinquent accounts: Removing access for accounts that either don’t pay, or break your terms of use.

- Cancellations and refunds: The ability to cancel mid subscription term and potentially refund a customer if needed.

On the flipside of this, you also need to facilitate recurring payments to ensure that you don’t lose customers who want to keep using your product. (More on that in our retention guide)

Stay compliant with sales tax and financial regulations

Sales tax and financial compliance is something you need to take into account at every point across your customer and payment journey.

First up, sales tax. For acquisition, specifically, this includes making sure you are collecting the right amount of sales tax at the checkout - this will be different depending on the type of software being sold and where your customers are based.

So for this you need to have access that tells you exactly where your customers are coming from to avoid getting caught out.

Other financial compliance regulations also exist around the world - each with its own nuances. For example, the rules regarding 3DSecure on one-time and recurring purchases are different in India than in many other countries. You’ll need some dedicated resource not only to manage compliance but also to look forward so you’re prepared for any new regulations or changes to existing ones that come into play.

Measuring success

Understanding how the different parts of your acquisition strategy are performing will help you see what’s working and where there’s room for improvement.

Below are a number of different SaaS metrics to track.

- Customer Acquisition Cost (CAC): How much it costs the business to acquire each new customer.

- Conversion rate: The percentage of prospects that convert into customers (or take a desired action on a page): This could be customers who complete the checkout and make a purchase, or those who sign up to a free trial (or who moved from free to paid). For sales-led businesses, it could be the number of prospects who sign up for a demo or ask to speak to sales.

- New Monthly Recurring Revenue (MRR): The monthly amount of money you receive from new subscription customers. You can combine this metric with CAC to determine the profitability of your new customers.

- Daily active users: The number of users who log in and use your product on a daily basis.

The role of revenue infrastructure

When it comes to customer acquisition in SaaS, you can have a stellar go-to-market strategy and a flawless onboarding flow but without a robust revenue infrastructure in place, you risk losing those hard-earned prospects before they convert into paying customers.

When we talk about revenue infrastructure, we mean the systems, processes and teams that are responsible for making sure those payments hit your bank account, in compliance with local regulations and in a way that makes life easy for your customers.

For acquisition, it means a lot of different pieces working together, including:

- Checkout

- Payments processors

- Subscription billing and management logic

- Onboarding and support processes

- Sales tax compliance management

- Reporting functionality

Broadly speaking, there are three main ways to build one for your business:

- Build the system in-house: Using internal resources to build subscription billing logic that works alongside your payment gateway. Dedicating headcount to maintain these systems and manage compliance.

- Piecemeal revenue stack: Integrating a number of different specialist tools together to create a stack that works for your business type.

- An all-in-one platform: Either using a merchant of record (MoR) or revenue platform that acts as a reseller and manages all aspects of this system under one roof.

To help you understand what exactly is required to build a robust revenue infrastructure, we’ve put together this guide - complete with checklist.

Get the guide. (No email required)

This guide is part of a three-part series on SaaS revenue infrastructure. Check out Part 2 to master your retention strategy or Part 3 to find out how you can build and implement a successful expansion strategy.