SaaS benchmarks: What to measure, and how

Explore popular SaaS benchmarks, how to put them to use, and common pitfalls.

Benchmarking is the practice of comparing performance metrics. Often, benchmarks provide the logic behind targets, which are then used to measure success. Without benchmarks, those targets are less meaningful. A target may be met, but who’s to say if it was too modest? Equally, targets that are too ambitious can be made more realistic by seeing what is happening elsewhere.

SaaS businesses have an exhaustive list of metrics to choose from as they decide how to benchmark their business. That choice can be a benefit, but also a curse. A SaaS business can quickly drown in benchmark analysis, and lose sight of how to apply them effectively. One of the key decisions that a SaaS business must make is what benchmarks it is going to use.

What to benchmark

SaaS businesses have a range of benchmark parameters at their disposal to understand if they are heading in the right direction, and why.

- External vs internal: For a startup with limited trading data, there’s little choice than to benchmark your business to others in your market. But more established businesses can call upon their own performance data to make month-on-month and year-on-year comparisons.

- By business priority: Not all SaaS businesses have the same priorities. For example, a startup will tend to be targeting rapid growth, and so metrics that point to the popularity of their service are important indicators. For other businesses, getting more value from the customers you already have is a higher priority than attracting new ones; and so metrics around usage and customer satisfaction are more relevant to them. Other SaaS businesses that are preparing for an IPO or private sale will have a keen eye on profitability, and so costs will be part of their benchmarking strategy.

- By business sector: Different markets can have wildly different understandings of success. For example, life insurance contracts can run up to 25 years, with little appetite to switch providers. Meanwhile customer loyalty in the mobile phone market is far more transient. Where you are matters too. Attitudes to adult learning (and so online learning providers) vary significantly across the EU.

- By business model: A SaaS business that makes its money from advertising will be interested in absolute customer numbers, whereas one that has a freemium model will want to understand how many of those customers they can expect to become paying subscribers, and by when.

- By business driver: SaaS businesses drive growth in different ways. Product-led SaaS businesses tend to grow faster, whereas a sales-led growth strategy focuses more on margin at the expense of speed.

- By product type: Some SaaS services are only meant to be short-lived, such as property search websites. Some expect repeat but irregular use, such as holiday booking apps. And others, for example social media platforms, are designed to hold your attention for as long as possible. Each scenario requires an appropriate measurement of customer engagement.

- By customer: B2B SaaS services can have complex buying journeys, involving multiple stakeholders over a period of time. Now compare that to a teenage gamer, who can become your customer in a matter of seconds. These two SaaS businesses are going to benchmark customer lead time and conversion in very different ways.

The main thing is to make sure you don't try to compare the incomparable

Benchmark your SaaS business to Zoom’s recent customer growth numbers, and you’re likely to come out second best. It grew by around 2,900% between December 2019 and April 2020*. A similar story with their revenue growth of 88%. But their net-revenue as a percentage of revenue - at 3% - may be a more relevant benchmark. (Source: Business of Apps) *Measured by daily meeting participants.

Let's look at an example:

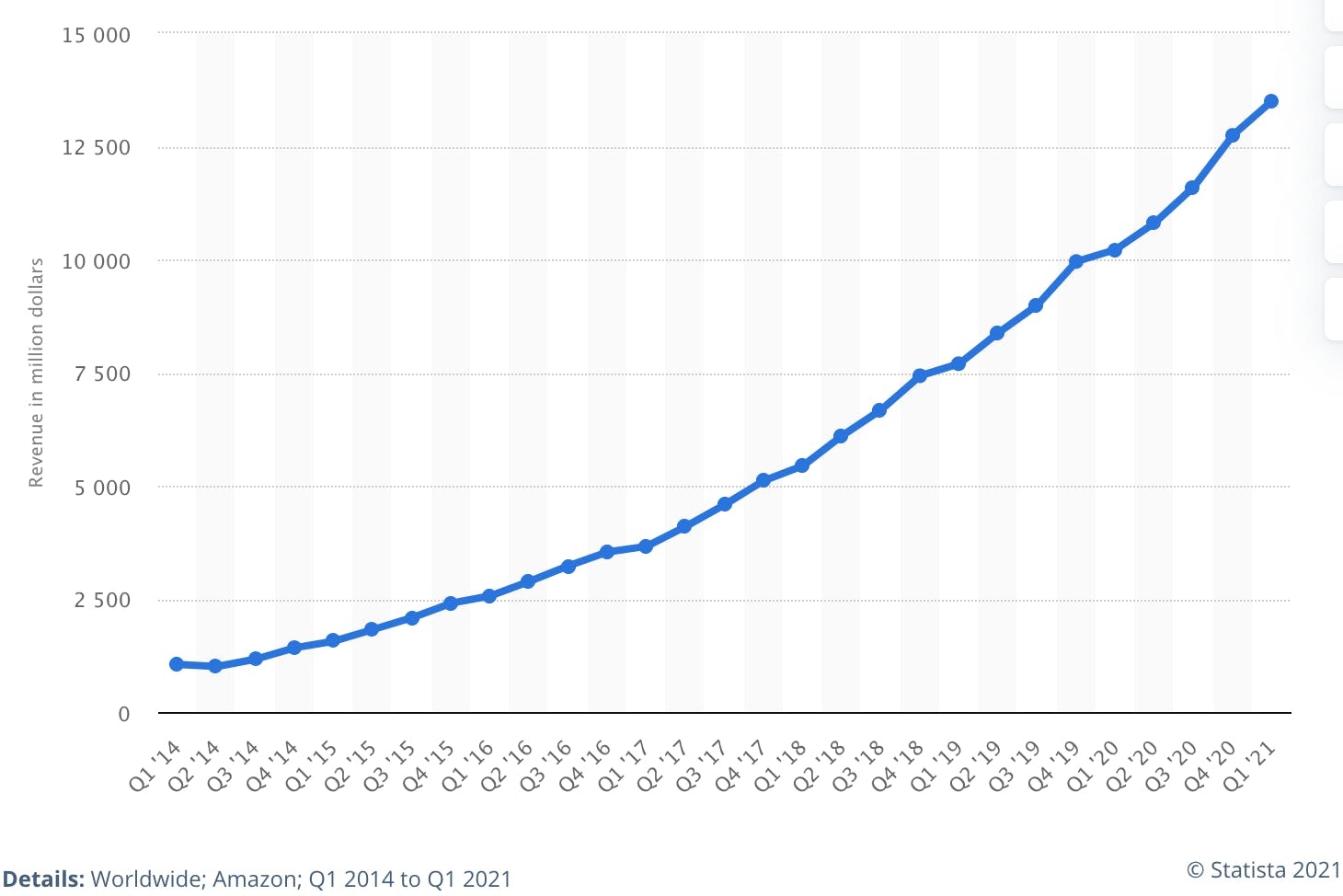

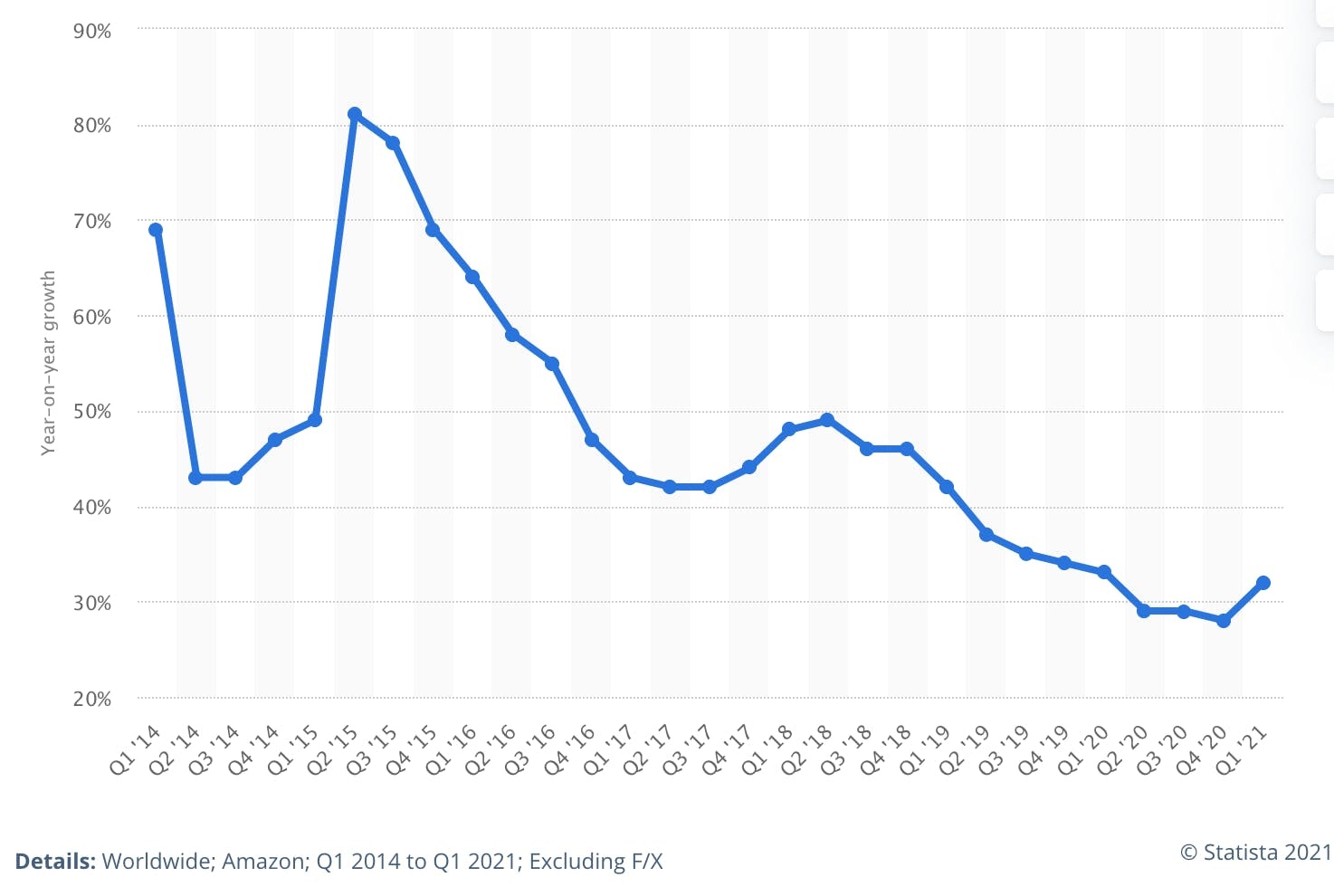

AWS - A tale of two lines

Revenue growth of AWS in real terms is unrealistic for almost every SaaS business...

... but percentage growth is not.

How to decide the right benchmarks for your business

With so many benchmark metrics to choose from, it can be difficult to land on the right ones for your business. The key is to approach the selection process as a project in its own right. Here are some of the factors you should consider.

Who decides?

As we have just read, SaaS businesses can define and drive success in lots of different ways. What’s important is that benchmarks align with these priorities and strategies. Therefore, benchmarking should be a leadership exercise. However, it can be important to bring in other stakeholders. For example, if the business is shaping up for a new investment round or IPO, there may be some standard benchmarks that the market expects to see. Also, experienced colleagues outside of the leadership team may be able to provide more granular insights and observations in deciding benchmarks for their specific line of business.

Inputs vs outputs

One of the early decisions that needs to be taken is the right balance between input benchmarks and output benchmarks. The former is defined by activities that generate a result (e.g. web traffic, prospecting calls), while an output benchmark is the result itself. For example, both these input benchmarks can be predictors of new customer growth, which is the output benchmark. If you are only measuring outputs, you may miss the root cause; and if you focus too heavily on inputs, you may be overly relying on your powers of predictive modelling.

Access to data

Ambitious benchmarking requires a lot of data. That’s fine if you can find the data, and analyze it. But it’s not always easy. Valuable and up to date external data can be expensive, and often means going to multiple suppliers to get everything you need. That then raises the challenge of analyzing these disparate data sources, often supplied in different formats. Similarly for internal benchmarking. Even mid-size SaaS businesses can run hundreds of different software systems, with data silos between them. It can prove problematic to find and extract the data you need, free from duplication and inaccuracies.

Actionable insights

Benchmarking’s value is in helping to steer a business to the right decisions. But if you’re looking at too many benchmarks, they can have the adverse effect, creating noise and confusion. Equally, benchmarking will almost always benefit from segmentation, which discounts less relevant points of comparison and outliers that can skew results. But again, there is a trade-off between how forensic you need to go, to get what you really need. The question should not be “Is this interesting?”, but “Can this be actionable?”

Benchmark interdependencies

SaaS markets and businesses are a complex maze of connections and interdependencies. So each benchmark should be appraised not only on the value of its insight, but how it relates to the other benchmarks you have selected. The aim should be to have a set of benchmarks that are complementary - in other words, a positive movement of one benchmark should result in a positive movement (directly or indirectly) in the rest, and vice-versa.

Regular review

SaaS businesses should never be static. Your priorities should adapt to new opportunities and challenges that come with time. As such, benchmarks need to be continually adjusted too. Reviewing your benchmarks every quarter will keep them - and your business - relevant.

Examples of SaaS benchmarks

Revenue Growth Rate:

The increase (or decrease) in sales revenue over a given period of time, expressed as a percentage. Positive revenue growth is a good indicator that a business is heading in the right direction. But it is not a very valuable benchmark by itself. For example, if costs are increasing at a higher rate than revenue, then the business is becoming less profitable. Sometimes, this does not matter. Both startups and enterprise SaaS businesses can target short-term growth at the cost of profit.

Average Revenue Per User (ARPU):

ARPU divides the total revenue of all subscribers by the number of subscribers, to determine how much revenue each subscriber is generating over a given period of time. A falling ARPU figure may not be evidence of subscriber churn in itself, but rather the loss of your highest-spending customers.

Monthly Recurring Revenue (MRR):

MRR ensures a SaaS business recognizes a subscriber’s revenue across the duration of their contract term, regardless of when payments are actually taken. Therefore, a customer with an annual contract worth £6,000 will have an MRR of £500. Recurring revenue can also be expressed in quarterly (QRR) or annual (ARR) terms. A falling MRR is usually a signifier of churn in absolute terms (i.e. subscriber numbers).

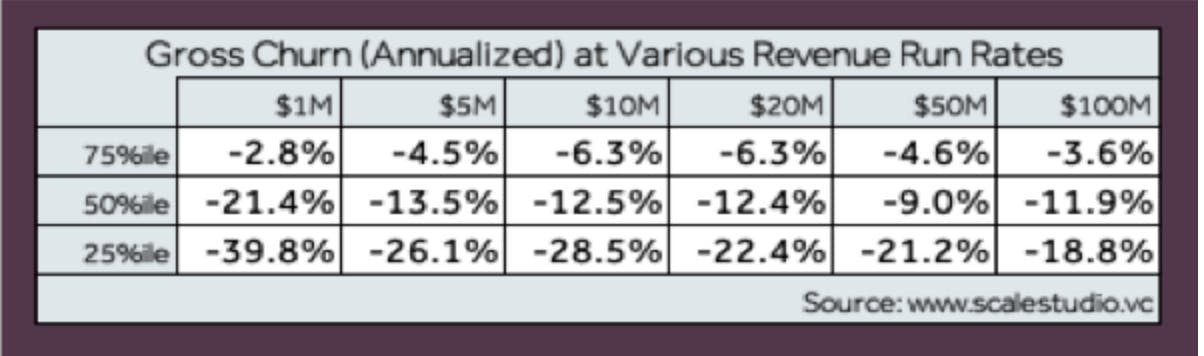

Customer Churn:

Getting a customer is one thing; keeping them is another. When a customer leaves, it is called churn. Customer retention is important to all businesses, but for subscription business models like SaaS, where revenue is realized at intervals over the full period of a contract, churn has a more profound impact, because most of the costs associated with that customer have already been sunk. (Find out more about SaaS churn benchmarks)

Source: Techcrunch

Customer Acquisition Cost (CAC):

The financial impact of churn is not just in lost revenue, but the cost of replacing the subscriber. A low CAC will tend to put less pressure on churn. CAC can be measured in varying degrees of accuracy. A general CAC benchmark will simply count advertising and marketing costs. But for SaaS businesses with tight margins, understanding CAC at a more granular level is important. So they may include a range of other costs, such as employee wages, agency costs and overheads. Therefore, when benchmarking against CAC, it is important to know how it has been calculated.

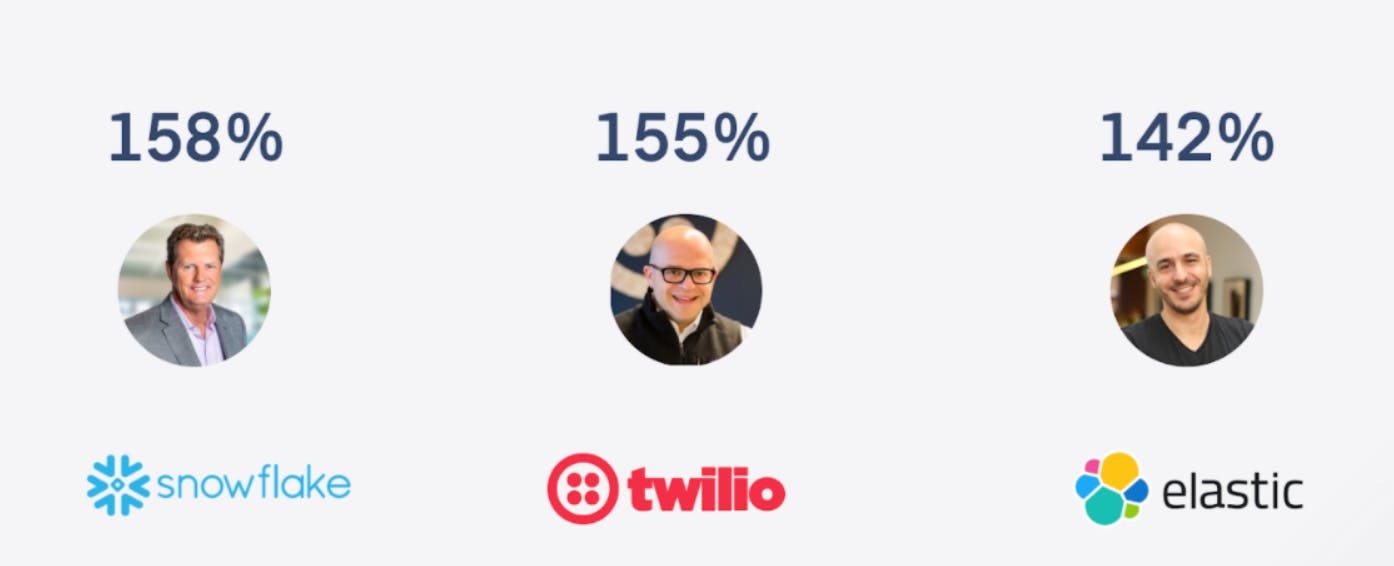

Net Revenue Retention (NRR):

NRR (sometimes known as Net Dollar Retention - NDR) takes recurring revenue a step further, by taking into account current customers who downgrade, pause or reduce their consumption alongside those who churn. NRR is expressed as a percentage, with anything under 100% showing revenue contraction. NRR is rapidly becoming the benchmark metric for SaaS companies. And you can see why when you look at the link between high NRR and legendary IPOs.

Operational benchmarks:

Not all SaaS benchmarks are directly subscriber or revenue related. Benchmarking against operational standards is also an important point of comparison. These can include:

- Payment metrics: Payments is becoming its own operational center, such is its impact on subscription numbers, revenue, and profits. Key payment metrics include payment success (the percentage of attempted payments that were successfully completed); chargeback rate (the percentage of payments that are refunded); and checkout conversion (the percentage of online shoppers who complete their transactions from the payments page).

- Lead generation metrics: SaaS businesses often run sophisticated marketing programs, designed to flow prospects through a series of engagements until they become subscribers. The number of prospects remaining in the funnel at each stage can be benchmarked - from the earliest moment (i.e. unidentified web traffic) to Marketing Qualified Leads (MQLs) and Sales Qualified Leads (SQLs).

- Brand metrics: SaaS businesses have an array of benchmarks at their disposal to understand how their brand is faring against others. These include quantitative metrics (e.g. social media Share Of Voice) and qualitative metrics (e.g. awareness and sentiment surveys).

- Employee metrics: The role that employees play in SaaS success is becoming increasingly scrutinized. Salaries and packages will be benchmarked to ensure they can attract the best talent, alongside more direct financial metrics, such as Revenue Per Employee.

Five key takeaways

1. Choose carefully: Some benchmarks are interesting, but not as relevant to your business as others. Others will be valuable, but too costly to access and analyze.

2. Go broad: SaaS benchmarks should not just be financial. Operational metrics from across marketing, HR, IT and others can be valuable indicators of performance.

3. Understand what you’re benchmarking: Benchmark terms are not uniform, and some studies will be more complete than others.

4. Segment where you can: The more you can strip out non-comparable elements, the more value you’ll get from what’s left.

5. Regularly review: Your business is changing, so what you’re benchmarking - and who you’re benchmarking against - needs to change too.

BONUS TAKEAWAY - Prioritise NRR: Net Revenue Retention has become the SaaS benchmark to have in your locker.

How your payments infrastructure enables SaaS benchmarking

A SaaS business is about much more than simply having a great product. CRM, subscription management, customer communication and payment management can be just as important drivers of growth. Consequently, these areas must also be considered when deciding which benchmarks to judge your business by.

But herein lies the issue for SaaS businesses. Benchmarking is fundamentally a data exercise; and the more things you want to benchmark, the more sophisticated your data operation needs to be. But many SaaS businesses simply aren’t resourced to meet their benchmark ambitions. They can be littered with data silos across different functions and systems. Worse still, they are not capturing the new data they are generating. Meanwhile, the market data they have sourced is hard to integrate. The result is benchmarking with questionable accuracy and relevance; analysis and tracking that happens in multiple places, and reporting that is manual, and so slow. The ultimate consequence is that benchmarking becomes too difficult and unreliable, and so sidelined.

A unified SaaS payments infrastructure addresses most of these issues. Revenue and user data are collected in the place it ‘happens’, so there’s no risk of corruption. And these individual records can be automatically rolled-up to perform macro-analysis of benchmarks over time, between customer demographics, and across product ranges. By bringing the analysis and reporting together with the operational features of a SaaS business - such as subscription management, customer communication, and payment management - your payment infrastructure can overcome the gap between benchmarks, and the activities they are measuring.