SaaS due diligence: What VCs are looking for

Every SaaS Founder seeking funding knows that, at some point, they’ll have to prove the viability of their business and spark some interest and excitement from potential investors.

This process is called due diligence and it involves:

- The pitch: You’ll pitch your vision, team, product, and business model to investors. It’s your chance to call out what big pain you are solving for the customer and what makes you better than what currently exists on the market.

- The financials: You’ll share a financial model that summarises your business’ financial position and performance against SaaS metrics .

- The product: You’ll share what unique product you have developed and the roadmap to help you achieve your mission.

It’s a crucial process for both investors and SaaS companies. For investors, it confirms whether or not the business is the right fit for them, and worthy of investment.

For you as a business leader, it’s your chance to find the funding necessary to execute on your fast growth plan and bring the right VC Partner onto your board to advise you on this journey.

Of course, none of that makes the process any less daunting.

Whether you’re currently seeking funding or thinking about it for the future, the secret is preparation. With that in mind, we spoke to Notion Capital to put together this checklist with everything you’ll need ready to get you through that initial stage.

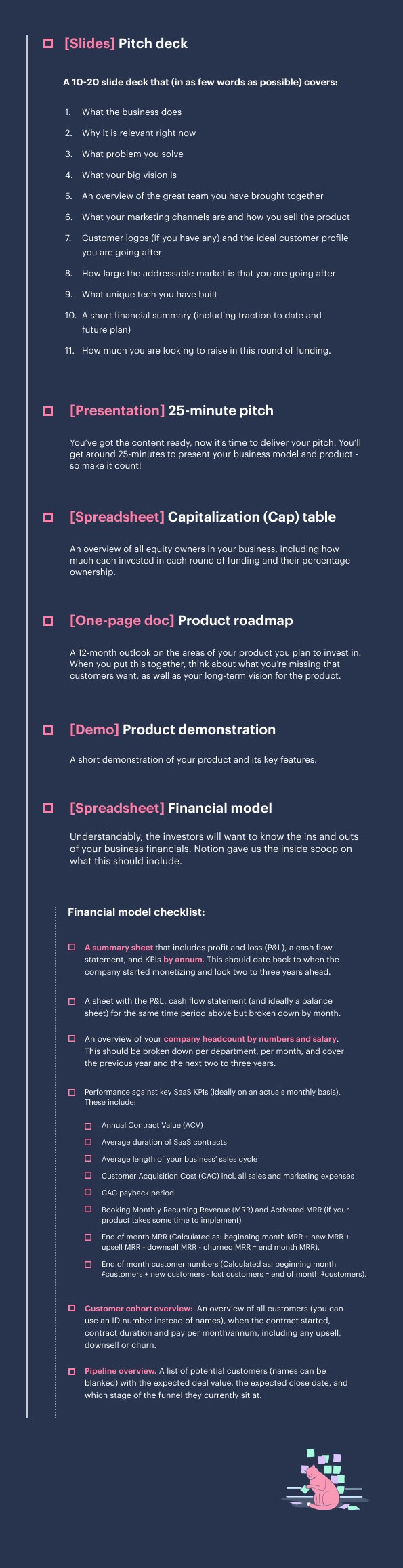

Funding due diligence checklist

The due diligence process is about proving the commercial viability and growth potential of your business. See the checklist below for the documents you’ll need and some pointers for what to include in each or download your own copy here.

We’ll be taking a closer look at these requirements in our upcoming webinar, on 18 November, joined by Notion Capital Partner Itxaso del Palacio and SaaS Advisors Managing Director Todd Gardner.